The number of bankruptcies filed by Canadian businesses is on the rise. According to the Canadian Association of Insolvency and Restructuring Professionals (CAIRP), there were 807 business bankruptcies and proposals filed in the first quarter of 2022. This is compared to 603 insolvencies filed at the same time last year.

Representing an increase of 34 per cent year-over-year, this is the highest increase recorded in more than 30 years. Dan Kelly is the president of the Canadian Federation of Independent Business (CFIB), the country’s largest non-profit organization working to support small businesses. He says this sharp rise could point to a growing wave of defaults among businesses in Canada over the months and years to come.

“Only about a third of the business losses during the pandemic were covered by government subsidies [and] the average small firm is taking on $160,000 in debt,” Kelly told CTV’s Your Morning on Wednesday. “So even if their sales were back to normal, they now have to make payments at higher interest rates on the debt that they've taken on during the pandemic and for many, that's the straw that breaks the camel's back.”

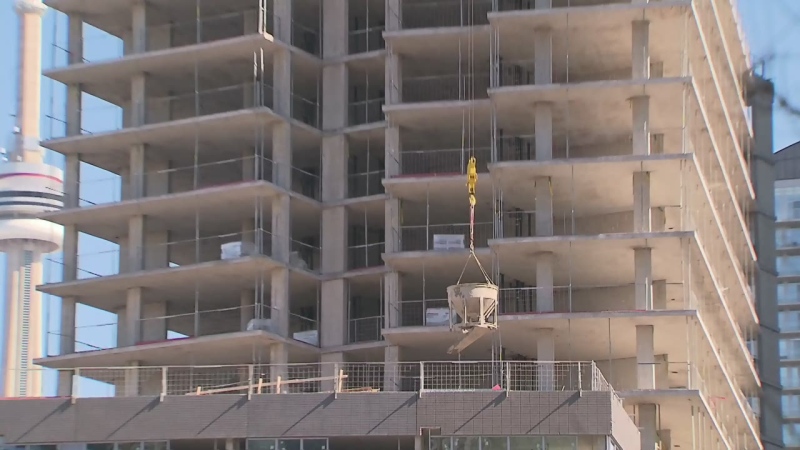

The number of business bankruptcies filed during the pandemic have remained below normal levels due to government subsidies and loans. However, with those supports no longer in place, Kelly said this has led numbers to rise. Sectors that saw the largest annual increase in bankruptcy filings were construction, transportation, and warehousing.

“Now that most of the pandemic restrictions like lockdowns and capacity restrictions are behind … these businesses are looking at their books and are saying, ‘Gee, I've got a ton of debt.’”

As a result of the COVID-19 pandemic, Kelly said it’s possible that as many as one in six small firms, or 180,000 businesses, will permanently close their doors across Canada, unable to pay off their debt.

“If that were to happen, think about the employment that that would take out of the system, and the impact that that would have right through the food chain as businesses go bankrupt and aren't paying their suppliers and aren’t paying even the banks for any debt that they've taken on,” Kelly said. “There's huge economic effects.”

Additionally, interest rate hikes by the Bank of Canada, as well as increasing inflation levels, could send businesses into insolvency at an even faster rate, the CAIRP has said.

In order to help slow the rate of bankruptcies filed by Canadian businesses, Kelly said part of the solution may lie in greater loan forgiveness. Nearly 900,000 businesses have been approved for Canada Emergency Business Account (CEBA) loans, with loan forgiveness of up to 33 per cent. Raising the rate of forgiveness would provide businesses with the help they need to stay afloat, Kelly said.

“If that were to rise … for some businesses that were hardest hit, we believe that more small firms will make it across the COVID finish line, and that's really what the economy needs,” he said.

Watch the full video with CTV’s Your Morning at the top of this article to hear more about what’s driving some Canadian businesses to file for bankruptcy.