Toyota is pumping more than C$45 billion into electric vehicles as it tries to catch up with other global automakers in the race to cleaner cars.

The world's biggest carmaker announced Tuesday that it would invest 4 trillion yen (C$45.2 billion) in developing battery-powered electric vehicles between 2022 and 2030 in a bid to mount a more serious challenge to rivals such as Tesla, GM and Volkswagen.

A large chunk of that money will go toward the batteries themselves, with the Japanese company committing another half trillion yen (C$5.6 billion) to the technology on top of 1.5 trillion yen (C$16.9 billion) previously announced.

The automaker currently sells just a few thousand battery electric vehicles each year. But it now plans to roll out as many as 30 new models by 2030, with the aim of selling 3.5 million such vehicles per year by 2030, Toyota President Akio Toyoda said at a press briefing in Tokyo.

That would be over a third of the company's sales last fiscal year, which totaled roughly 9 million vehicles worldwide.

The Lexus luxury brand is a huge part of the new plan, with Toyota projecting 1 million global EV sales by 2030. Toyota wants all Lexus sales in Europe, North America and China to be battery-powered electric vehicles by the end of this decade, and globally by 2035.

CATCHING UP

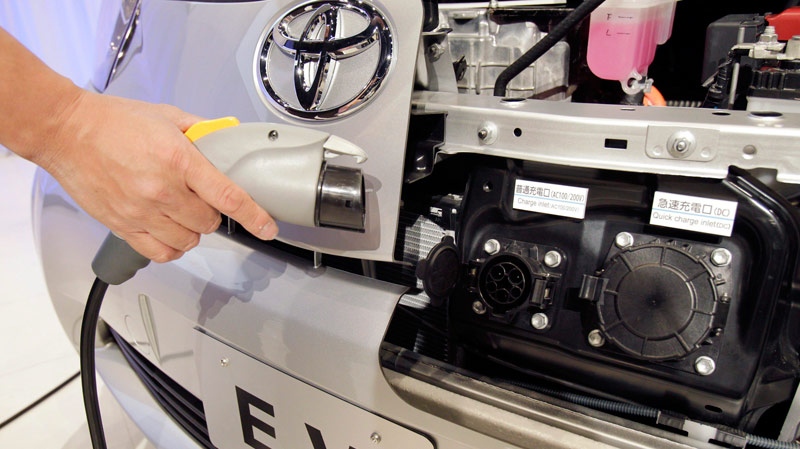

While Toyota has been a pioneer in hybrid and even hydrogen fuel cell-powered vehicles, it has been much slower than some other major automakers to expand into the fully-electric vehicle market.

Electric vehicles, including hybrid and fuel cell cars, accounted for nearly 28 per cent of the company's sales in the six months ended September. But battery-powered electric cars were a tiny component of that, making up just 0.1 per cent of total sales.

In the early 2000s, one of Toyota's most recognizable hybrids, the Prius, was received with the sort of excitement and wait lists now seen for Tesla models. Other automakers were criticized for not making similar models at the time.

Almost 20 years after the sensation, however, it is Toyota that is playing catchup in fully-electric cars and SUVs.

Standing in front of more than a dozen electric vehicles on Tuesday, Toyoda called the new lineup "our showroom of the future" and said the manufacturer would also seek to make its factories carbon neutral by 2035.

That moves up a previous pledge from the company to become carbon neutral by 2050, which means its cars and production processes will not add carbon dioxide to the Earth's atmosphere. Other industry players, such as GM and Mercedes, have made similar pledges.

"The future that we showed you today is by no means far away," Toyoda told reporters, adding that most of the models shown Tuesday would be released over the next few years.

But competition is intensifying. Just last week, Volkswagen announced that it would raise its budget for electric vehicles, to C$128 billion. The German behemoth, which has long been virtually neck and neck with Toyota in global sales, also said it hoped that 25 per cent of its vehicle sales worldwide would be electric by the end of 2026.

RED-HOT DEMAND

EV batteries are also becoming a hot topic among investors elsewhere in Asia.

This month, LG Energy Solution, a battery supplier for the likes of Hyundai and Siemens, announced it would go public in South Korea, with the goal of raising up to 12.75 trillion won (C$13.8 billion).

The market debut, which is expected to take place in January, would be the country's biggest initial public offering on record, according to Dealogic.

In a statement, LG Energy Solution CEO Young Soo Kwon said that the company's IPO was about "preemptively responding to the demand for the lithium-ion battery industry, expected to see rapid growth."

Peter Valdes-Dapena contributed to this report.