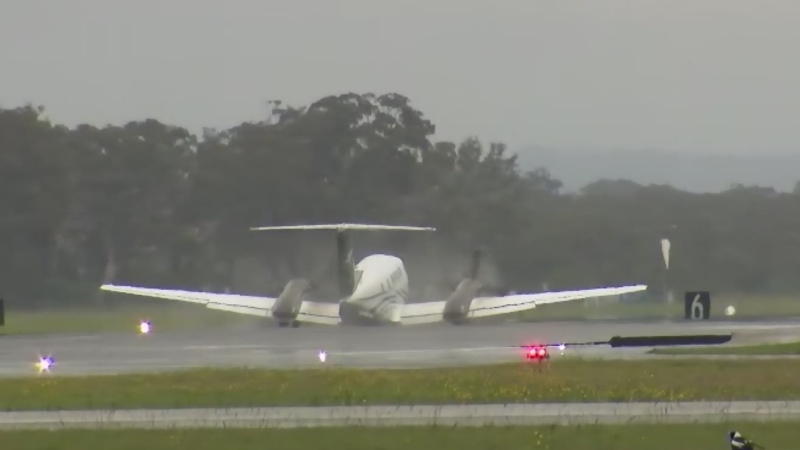

OTTAWA -- The federal government announced Tuesday that it would give Air Canada more time to eliminate the $4.2-billion deficit in its pension plan, but imposed strict rules on the airline that limit executive pay and prevent it from paying dividends.

"By taking this action, we are ensuring that Air Canada remains viable, that thousands of jobs are protected and the service is there when Canadians need it," Finance Minister Jim Flaherty said in a statement.

"Air Canada is the country's largest airline and contributes significantly to the Canadian economy."

The deal requires the airline (TSX:AC.B) to make contributions to the plan of at least $150 million a year totalling at least $1.4 billion over seven years, on top of the regular contributions required by the plan.

The agreement also freezes increases in executive pay at the rate of inflation, prohibits special bonuses and puts limits on executives' incentive plans. The airline will also be prevented from paying dividends and buying back stock as well as making any pension plan benefit improvements without regulatory approval.

Air Canada's pension deficit has been a chronic problem for the airline due to low interest rates which have driven up liabilities.

The airline had wanted Ottawa to put a $150-million cap on its annual solvency deficit payments for the next decade, starting in 2014.

Flaherty noted that Air Canada's unions and retirees have been supportive of the company's request for help with its pension deficit.

"This regulatory change is not costing Canadian taxpayers a single dollar, but it is providing Air Canada time to pay off the sizeable pension deficit," the minister said

In 2009, Air Canada signed a deal with the federal government that granted the airline a moratorium on special pension contributions to reduce its deficit for that year and 2010. Under that deal, which expires next year, Air Canada was required to make $150 million in special payments in 2011, $175 million in 2012 and $225 million in 2013.

The Air Transport Association of Canada had argued against Ottawa granting Air Canada pension relief, saying it would create an uneven playing field.

The group, which represents small regional carriers and training centres, argued that Ottawa should provide broad pension assistance to all Canadian companies, instead of giving a competitive advantage to the former Crown corporation.

"We don't really have anything to add, but that we respect the government's decision," said John McKenna, president and CEO of ATAC.

McKenna said the group has decided to be more "cautious" after it was falsely accused of being overly critical of the airline.

Last week, it posted a public apology on the front page of its website for the open letter it had written to the federal government to voice its concerns.

Air Canada has said that cost savings from its recent labour agreements, the startup of low-cost carrier Rouge and pension relief will help to lead the airline to sustainable profits.

Shares in Air Canada closed down six cents to $2.57 Tuesday on the Toronto Stock Exchange.