A Canadian taxpayers group thinks drivers are paying too much for gas and they’re digging into their pockets to prove it.

Members of the Canadian Taxpayers Federation were at a gas station on Thursday to hand out symbolic gas tax refunds to drivers in a gesture to demonstrate how much they’re being taxed.

According to Statistics Canada’s most recent Survey Household Spending, the average Canadian household spends about $2,606 per year on gas. With gasoline taxed at an average rate of 29 per cent, that means families are paying about $756 per year in gas taxes.

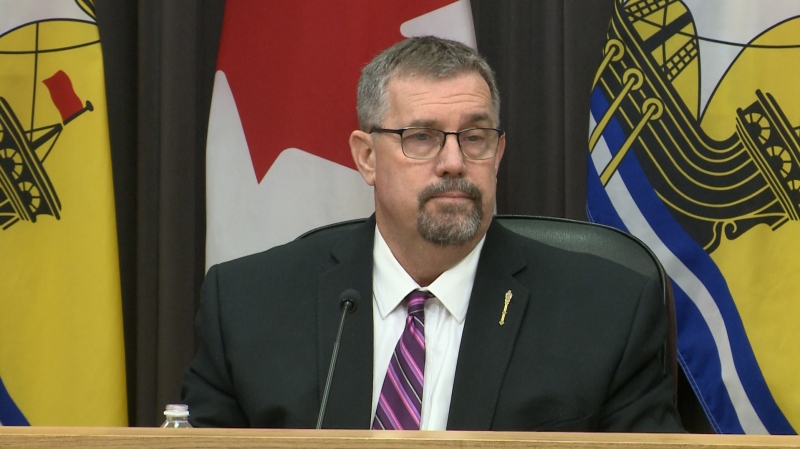

“It’s time Canadian governments came clean with Canadians about how much they’re ripping them off at the gas pump,” said Gregory Thomas, federal director of the Canadian Taxpayers Federation. “It’s time they got rid of taxes on taxes.”

Not only are drivers forced to pay federal excise taxes on gas, they’re also paying GST and HST on top of that tax.

“Drivers are getting hosed,” Thomas said about gas prices. “These are slot machines for governments, thinking they can just reach in and take the money out of taxpayers’ pockets.”

“It’s an easy way for the government to pump Canadians’ wallets. Everybody has to drive.”

When it comes to the price at the pumps across Canada, some drivers definitely have it worse than others.

Gas in New Brunswick for instance, sells for about three cents cheaper per litre than in Nova Scotia. Similarly, gas in Ontario sells for eight cents less a litre than it does across the river in Quebec.

“They had the worst system in the country,” said Thomas of Quebec, which has the highest gas tax rate in Canada.

As long as the federal government is going to collect taxes on gas, the CTF recommends dedicating a portion of revenues to projects that benefit drivers like municipal road development and maintenance.