TORONTO -- We have all heard the warnings: Be prepared financially should a second wave of the pandemic come this fall.

But what exactly does "be prepared" mean?

I look at it two ways.

The first is having an emergency fund.

Ideally 3-6 months' living expenses set aside in the event businesses are faced with closing down yet again and you find yourself potentially unemployed.

Or you may be working in an industry that may never come back as lifestyles change with more working from home. On the economic front, the unemployment rate stands at 10.9% and while we have recouped about 55% of the three million jobs lost between February and April recently, most of the new jobs were "part-time."

You need to control what you can and that likely comes down to what you spend and where you spend it due to the fear of the unknown.

The second point of financial preparedness focuses on making sure your money is working as hard for you as you are working for it.

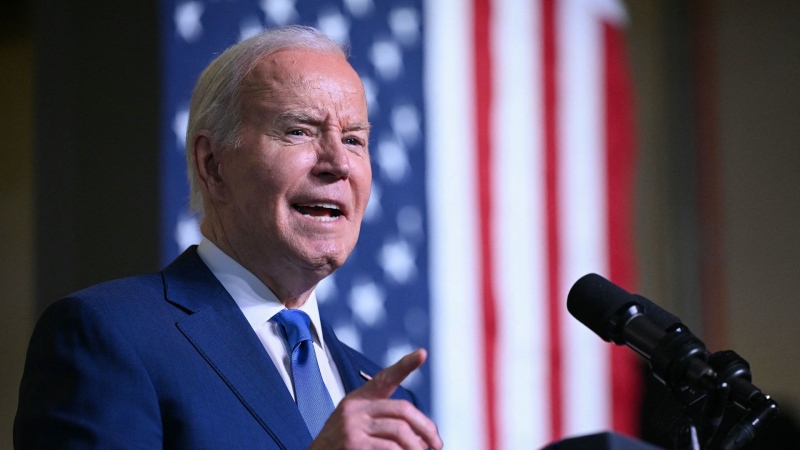

It has been a challenging year for investors. The TSX during the early days of the pandemic was slammed. And volatility remains as tension continues to mount between the U.S. and Canada and has recently heightened after the U.S. moved to impose higher tariffs on some Canadian aluminum products. There are escalating tensions between Washington and Beijing after U.S. President Donald Trump banned transactions with Chinese apps TikTok and WeChat. Plus another ramp-up in China-U.S. tension after Beijing announced sanctions against 11 Americans in a tit-for-tat move following the Trump administration’s sanctioning of 11 Chinese officials on Friday.

Through it all, jobs have been lost, small businesses have been struggling and portfolios rebounding slowly. The TSX is now only off 3.04% year to date and yet the drivers recently in the market have been tech darlings such as Spotify and miners with gold hitting an all-time high recently as the safe haven play becomes the investment of choice. The TSX has not enjoyed a broad based advance.

Now is the time to review your investment portfolio. I'm a firm believer in having financial flexibility meaning cash, and liquidity continues to be important as we work our way through the uncertainty surrounding the pandemic.

Begin with an honest perspective on your time horizon and risk tolerance. Be clear on when you need your money and focus not only how much you might be willing to lose in the market but how much you can afford to lose. Look closely at your concentration risk and determine if you have too much exposure in one company or one sector. Are your investments diversified across the asset classes such as cash, fixed income and stocks and is the weighting in each area right for you? For illustration only, we have in our portfolio 10% cash, 60% fixed income and 30% stocks.

Finally, if you have time on your side (minimum 5 years) and are satisfied that you can withstand the volatility that is likely coming our way consider tiptoeing into beaten down stocks that pay a great dividend and have a history of paying that dividend over time. You are going to be paid to wait out the storm via the the dividend payment.

We don't know for sure what the fall will bring but unlike when the pandemic first hit we now have a rare opportunity to prepare ourselves financially so we aren't blindsided again.