TORONTO -- North American stock markets are heading toward their first monthly losses since March's sharp correction after drifting lower on the penultimate day of trading in September.

The tech-heavy Nasdaq is leading the declines and is on track to lose 5.5 per cent for the month.

“The TSX is actually outperforming all of its global peers and again that's mainly attributed to the fact that the tech sector has assumed the brunt of the selling pressure this month,” said Candice Bangsund, portfolio manager for Fiera Capital.

The Toronto-based market is 1.9 per cent lower with one day of trading remaining, while the S&P 500 is down 4.7 per cent and the Dow is off 3.3 per cent.

“I think it says first and foremost that the unrelenting rally in tech stocks was probably overdone and due for a pullback,” she said in an interview.

The more value-oriented sectors like energy, financials and industrials haven't participated in the strong summer rally but will outperform technology as investors take some profits in tech after some massive gains, she added.

Markets declined Tuesday on uncertainty over U.S. politicians reaching a fiscal stimulus agreement before the election and concerns that a spike in global COVID-19 infection rates is threatening to derail the economic recovery.

Bangsund said the renewed market volatility in September can be attributed to a second or third wave of cases in Europe, the U.S. and even Canada.

“Investors are digesting these headlines of rising cases that threaten the return of those economically disruptive measures to contain the spread of the virus,” she said, pointing to record new cases in Britain, Spain and France that are twice as high as the peaks earlier this year.

“So it's creating a worrisome backdrop and unnerving investors, given the potential for renewed restrictions that would inevitably weigh on economic activity.”

That was partially offset Tuesday by a rebounding of U.S. consumer confidence in September that exceeded economist expectations.

The S&P/TSX composite index closed down 31.29 points to 16,211.52 after hitting an intraday low of 16,131.51.

In New York, the Dow Jones industrial average was down 131.40 points at 27,452.66. The S&P 500 index was down 16.13 points at 3,335.47, while the Nasdaq composite was down 32.28 points at 11,085.25.

The Canadian dollar traded for 74.68 cents US compared with 74.75 cents US on Monday.

Energy led the sector declines on the TSX, falling by 4.3 per cent on a drop in crude oil prices over renewed demand worries.

The November crude oil contract was down US$1.31 at US$39.29 per barrel and the November natural gas contract was down 23.4 cents at US$2.56 per mmBTU.

Several Canadian oil producers sustained share price losses, led by Crescent Point Energy Corp. down 6.4 per cent, Vermilion Energy Inc. 6.2 per cent lower and Cenovus Energy Inc. off 5.6 per cent.

Financials was down 1.4 per cent.

Technology was one of four sectors to gain, rising 1.8 per cent as shares of Shopify Inc. climbed six per cent after it announced a shuffling of its executives and departure of saying goodbye to a member of its leadership team..

Materials rose nearly one percentage point as higher gold prices helped companies like MAG Silver Corp., which was up 8.9 per cent.

The December gold contract was up US$20.90 at US$1,903.20 an ounce and the December copper contract was unchanged at US$2.99 a pound.

“Gold is rising today with unnerved investors flocking to the safety of the safe haven metal, while the weak U.S. dollar is also boosting gold prices,” said Bangsund.

Industrials was up slightly even though Air Canada dropped 3.7 per cent.

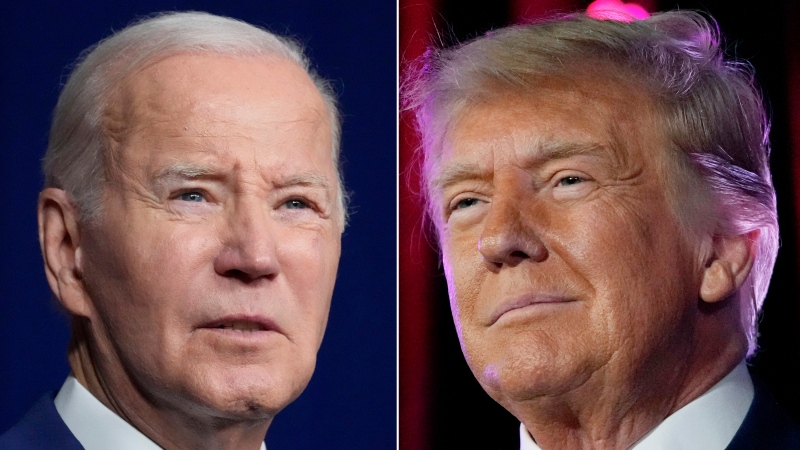

Bangsund said investors will be watching closely the outcome of Tuesday night's U.S. presidential debate, keeping an eye on polls and betting after the event.

Democratic nominee Joe Biden's lead in polls is likely providing some calm to markets despite concerns about his promise to raise corporate taxes, she said.

“I think the bigger concern would be if the polls narrowed and it was looking like an increasingly tight race that would spark the risk of a contested or inconclusive result,” Bangsund noted.

“And that, of course, could create some volatile conditions in November. So, it will be key to be watching the polls following the debate this evening.”

This report by The Canadian Press was first published Sept. 29, 2020.