When the founder of Canada’s biggest cryptocurrency exchange died in December, he took the passwords required to access up to $180 million with him. The company, Quadriga, is now in creditor protection and the news is raising questions about how risky it is to use new digital currencies.

Jean-Philippe Vergne, an associate professor who studies cryptocurrency at Western University in London, Ont., told CTV News Channel on Tuesday that people need to understand that the sector, which allows people to trade using digital assets like Bitcoins, is “very loosely” regulated.

“The industry that we’re talking about works very differently from the traditional financial sector,” Vergne said.

With cryptocurrency, “if you have the password, you have full access to the funds,” according to Vergne.

Vergne points out that banks have insurance policies that allow depositors to get their money back if, for example, there’s a robbery.

“A lot of cryptocurrency exchanges do not subscribe to any insurance policy even though they could,” he says.

The government-owned Canada Deposit Insurance Corporation protects eligible deposits up to $100,000 in case a bank fails. But that doesn’t apply to cryptocurrency.

At the same time, Vergne says it’s surprising that only one person at Quadriga would have had the passwords. “It’s either a huge oversight or there is more to the story,” he said.

The Ontario Securities Commission surveyed Ontarians about cryptocurrencies last year and found that tens of thousands “may be placing highly risky bets on cryptoassets, and that many cryptoasset holders are confused about how they are regulated.”

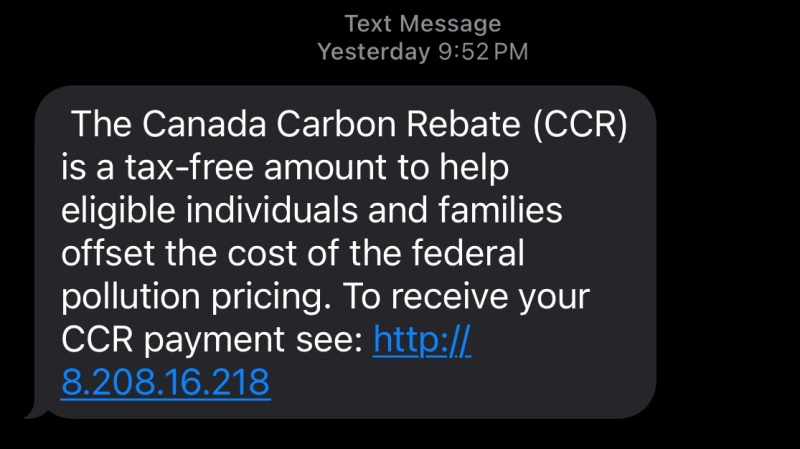

The OSC has published a guide called “Get Smarter About Cryto” that warns the public that cryptoasset trading platforms “are not the same as regulated stock exchanges” says that “cyberattacks are a big risk.”

“Data show that any prospective purchaser in this sector faces long odds,” the OSC says. “Many cryptoassets have failed, and many schemes purporting to offer cryptoassets have turned out to be fraud.”

Vergne also says that potential investors should be cautious.

“People should be very, very careful who to trust,” he advised.