Benjamin Franklin is famous for declaring that “nothing can be said to be certain except death and taxes.” But in some cases there are ways to avoid the latter. The only question is: who pays?

Al Fulcher and Wally Erickson are two retired Canadians living in British Columbia. They filed their taxes and believed they did everything right. But both ran into auditors from the Canada Revenue Agency who reassessed their claims.

The CRA told Fulcher he owed $217,000 and put a lien on a commercial property he bought to finance his retirement. The CRA maintained that the money Fulcher used after the BC government expropriated his property was subject to capital gains tax. That meant Fulcher couldn’t refinance his mortgage at a normal commercial rate.

Suddenly Fulcher was facing bankruptcy. Fulcher said the CRA action “ruined my credit rating. It’s ruined my credibility.”

Erickson also got audited. The CRA told him he owed $200,000. Erickson was denied a capital cost allowance and other claims on a boat he purchased after his retirement. He said the audit “has so many errors in it, mathematical errors, calendar years, money was included in both calendar years, it was just ludicrous.”

Erickson fought back representing himself before Canada’s tax court.

They’re two Canadians of limited means, willing to pay their fair share of taxes but not willing to accept rulings by CRA auditors.

But 106 other Canadians, much richer and with more resources, took a different approach to their tax obligations. They put their money, a total of more than $100 million, into 47 accounts in the tiny tax haven principality of Liechtenstein.

The Canada Revenue Agency only found out about the accounts in 2007 after it got the names from files stolen from LGT Trust, a bank owned by the monarch of Liechtenstein.

A data processor, Heinrich Kieber, at a Liechtenstein bank walked out with discs containing all the information of 3,500 accounts. Kieber then traded the information to the German government for millions and a new identity.

Germany and Austria used the Kieber files to prosecute their citizens who were evading taxes. Heinz Frommelt, a former Justice Minister in Liechtenstein and now a tax lawyer, said Kieber’s files “have all the data needed to prosecute.”

Katja Gey, Liechtenstein’s Director of International Financial Affairs confirmed the files “are probably good enough for an investigation or prosecution.”

Canadian funds abroad

What about Canada’s investigation of those Canadians named in Kieber’s files?

W5 asked the CRA about the 106 Canadians. The CRA says all were audited and 25 were reassessed. After those audits were completed, the back taxes, interest and penalties totaled $22 million but so far only $8 million has been collected.

The CRA says its investigation is complete and no tax evasion charges will be laid.

Sen. Percy Downe has followed the Liechtenstein case for six years. He said that “people who hide their money overseas are getting a sweetheart deal and the rest of us have to pay our taxes.”

Downe pointed to CRA’s own documents. He said, “The CRA has proven in their own internal audit that they go after the easier cases.”

“The people who are hiding money overseas are intentionally trying to avoid paying taxes,” Downe said.

After six years, we do not know any of the names of those 106 Canadians who put their money in the LGT Bank. The CRA says privacy laws prevent them from being released.

W5 caught up to Minister of Revenue Gail Shea in her riding in Summerside, Prince Edward Island. We asked her about the decision not to charge any of the 106 Canadians with tax evasion.

“I can’t speak to specifics but I can tell you that since our government came into office we have uncovered $4.6 billion in taxes owed,” Shea said.

In an e-mail to W5, after broadcast of our story, the minister's director of communications added clarification: "Over the last six years, 7,761 Aggressive International Tax Planning cases have been completed with approximately $4.58 billion in additional taxes identified."

Asked to provide a specific figure of how much tax had been collected of the amount "identified" and from those individuals, the CRA claimed it is unable to do so. "Our audit and collection systems are standalone systems that do not interface in a manner that would allow the CRA to track the answer being sought."

Fighting on the home front

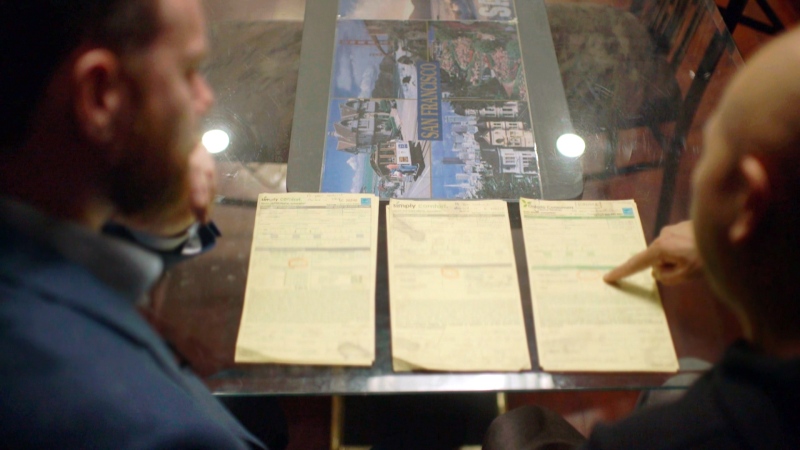

Although secrecy surrounds the Liechtenstein cases, we know what happened to Al Fulcher and Wally Erickson in British Columbia.

Erickson got the CRA to knock down the amount owing from $200,000 to just over $51,000. But he still thought that was too high. He went to tax court in 2012. The tax court reduced Erickson’s tax bill another $15,000 to $36,000 including interest and penalties.

Al Fulcher hired a tax expert to prove to the CRA that its own regulations allowed him to use his money from the expropriation and not pay a capital gain. But by the time the CRA withdrew its claim in 2012, Fulcher was left almost bankrupt.

His house is for sale and he is still trying to save the business he bought. Fulcher said he’s trapped.

“I now have to fight the CRA for some kind of compensation…I can’t give up and walk away from this thing, this is just ludicrous.”

It’s worth recalling another famous line about paying taxes. This one is from Leona Helmsley, a billionaire New York property owner.

During her trial for tax evasion in 1983, she was quoted as saying: "We don't pay taxes. Only the little people pay taxes."

Watch W5's 'Tax me if you can' Saturday night. Check local listings.