With pressure growing to act, Liberals reference inflation worries in throne speech

The federal government is promising to tackle the rising cost of living as it faces pressure to lay out a plan to help cool inflationary pressures.

The annual inflation rate hit an 18-year high in October, fuelled largely by rising prices at the pumps and grocery store aisles, with help from housing costs that may be shaking off their mid-year moderation.

Adding to price pressures are snarled supply chains around the globe that have been unable to keep up with rising consumer demand for goods.

Tuesday's throne speech, which laid out the Liberals' priorities for their third mandate, noted that inflation worries are affecting countries around the world.

And while it also touted Canada's economic performance, including employment having returning to pre-pandemic levels, the text of the speech said the country must tackle the rising cost of living.

While the text pointed to Liberal campaign promises on child care and housing, it fell short of what business groups and the Opposition Conservatives were looking for in the lead-up to the speech.

Besides a plan to unclog supply-chain bottlenecks, there were also calls for the Liberals to tap the brakes on spending plans, worried that too much could spur inflation and hinder an economic recovery.

The government's plan for the economy will go before the House of Commons in the coming days.

Finance Minister Chrystia Freeland is set to introduce a bill that would provide support to still-hurting industries like tourism and send unemployment aid to workers subjected to lockdowns.

The throne speech noted the government is "moving to more targeted support, while prudently managing spending."

Speaking ahead of Tuesday's throne speech, Conservative finance critic Pierre Poilievre suggested his party could support targeted relief, but not the Liberals' planned $100 billion in stimulus.

"We believe we should get back to normal pre-COVID levels of spending. We don't believe that it is necessary to create new, permanent, multi-billion dollar programs that did not exist before COVID," Poilievre said.

"What we need to do is get back to affordable government so that we can get an affordable cost of living."

Inflation rates are expected to remain high through the end of the year, and above the Bank of Canada's two-per-cent target into 2022.

This report by The Canadian Press was first published Nov. 23, 2021.

IN DEPTH

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

Trudeau, key election players to testify at foreign interference hearings. What you need to know

The public hearings portion of the federal inquiry into foreign interference in Canadian elections and democratic institutions are picking back up this week. Here's what you need to know.

Who is supporting, opposing new online harms bill?

Now that Prime Minister Justin Trudeau's sweeping online harms legislation is before Parliament, allowing key stakeholders, major platforms, and Canadians with direct personal experience with abuse to dig in and see what's being proposed, reaction is streaming in. CTVNews.ca has rounded up reaction, and here's how Bill C-63 is going over.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

TREND LINE What Nanos' tracking tells us about Canadians' mood, party preference heading into 2024

Heading into a new year, Canadians aren't feeling overly optimistic about the direction the country is heading, with the number of voters indicating negative views about the federal government's performance at the highest in a decade, national tracking from Nanos Research shows.

Opinion

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

opinion Don Martin: Pierre Poilievre's road to apparent victory will soon start to get rougher

Pierre Poilievre and his Conservatives appear to be on cruise control to a rendezvous with the leader's prime ministerial ambition, but in his latest column for CTVNews.ca, Don Martin questions whether the Conservative leader may be peaking too soon.

CTVNews.ca Top Stories

B.C. woman facing steep medical bills, uncertain future after Thailand crash

The family of a Victoria, B.C., woman who was seriously injured in an accident in Thailand is pleading for help as medical bills pile up.

LIVE @ 4 EDT Freeland to present 2024 federal budget, promising billions in new spending

Canadians will learn Tuesday the entirety of the federal Liberal government's new spending plans, and how they intend to pay for them, when Deputy Prime Minister and Finance Minister Chrystia Freeland tables the 2024 federal budget.

Ontario woman charged almost $7,000 for 20-minute taxi ride abroad

An Ontario woman was shocked to find she’d been charged nearly $7,000 after unknowingly using an unauthorized taxi company while on vacation in January.

WATCH Half of Canadians living paycheque-to-paycheque: Equifax

As Canadians deal with a crushing housing shortage, high rental prices and inflationary price pressures, now Equifax Canada is warning that Canadian consumers are increasingly under stress"from the surging cost of living.

Inmate who escaped from N.B. prison has long history of violent crimes

An inmate who escaped from Dorchester Penitentiary in Dorchester, N.B., on Saturday evening has a long history of violent crimes and a history of escaping custody.

Annual inflation rate increased to 2.9% in March

The annual inflation rate ticked higher in March compared with February, boosted by higher prices for gasoline, Statistics Canada said Tuesday.

Tim Hortons launches pizza nationally to 'stretch the brand' to afternoon, night

Tim Hortons is launching flatbread pizzas nationally in a bid to pick up more afternoon and evening customers.

Thousands of dollars worth of tropical fish stolen from Ottawa Valley restaurant

Ontario Provincial Police are investigating the theft of "several thousand" dollars worth of tropical fish stolen from an Upper Ottawa Valley restaurant last week.

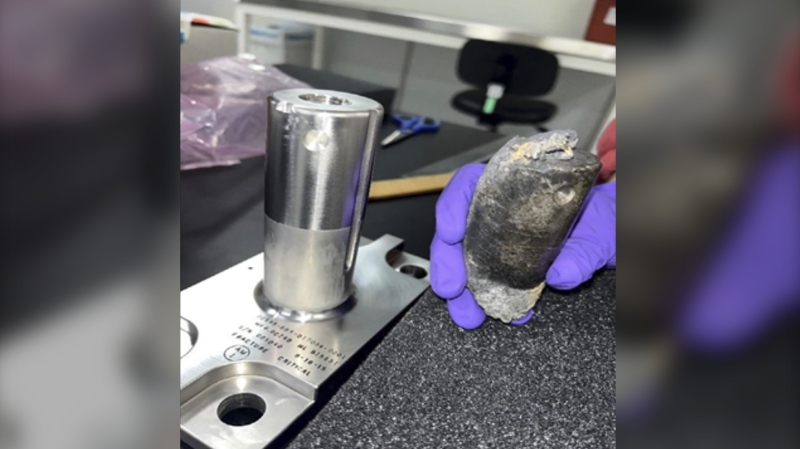

NASA confirms mystery object that crashed through roof of Florida home came from space station

NASA confirmed Monday that a mystery object that crashed through the roof of a Florida home last month was a chunk of space junk from equipment discarded at the International Space Station.

Local Spotlight

Ottawa barber shop steps away from Parliament Hill marks 100 years in business

Just steps from Parliament Hill is a barber shop that for the last 100 years has catered to everyone from prime ministers to tourists.

'It was a special game': Edmonton pinball player celebrates high score and shout out from game designer

A high score on a Foo Fighters pinball machine has Edmonton player Dave Formenti on a high.

'How much time do we have?': 'Contamination' in Prairie groundwater identified

A compound used to treat sour gas that's been linked to fertility issues in cattle has been found throughout groundwater in the Prairies, according to a new study.

'Why not do it together?': Lifelong friends take part in 'brosectomy' in Vancouver

While many people choose to keep their medical appointments private, four longtime friends decided to undergo vasectomies as a group in B.C.'s Lower Mainland.

Grain-gobbling bears spark 'no stopping' zone in Banff National Park

A popular highway in Alberta's Banff National Park now has a 'no stopping zone' to help protect two bears.

Deer family appears to accept B.C. man as one of their own

B.C. resident Robert Conrad spent thousands of hours on Crown land developing an unusual bond with deer.

Doorbell video shows family of black bears scared off by dog in Sudbury, Ont.

A Sudbury woman said her husband was bringing the recycling out to the curb Wednesday night when he had to make a 'mad dash' inside after seeing a bear.

Quebec teacher fired after taking leave to be on 'Survivor' reality TV series

A school teacher who took part in the Quebec version of the Survivor reality TV show took time off work to be a contestant is now out of a job.

Young P.E.I. actor fulfills childhood dream to play Anne Shirley

A young actor from Prince Edward Island is getting the chance to fulfill a childhood dream, playing the precocious and iconic Anne Shirley on stage.