Finance Minister Jim Flaherty caused a stir in Ottawa on Wednesday by challenging one of the Conservative Party’s key election promises – income splitting for families.

In a post-budget interview at the Ottawa Chamber of Commerce, Flaherty said he personally thinks that fulfilling the pledge – which could cost up to $2.5 billion – is not the best way to spend money.

"I would pay down public debt and reduce taxes more, myself, but I am only one person," he said.

"We've created a large public debt and we should deal with it and we should knock it down," Flaherty added. "Not for my sake, it won't make any difference to me, but it will make a big difference to the next generations."

Income-splitting would allow families with children under age 18 to split up to $50,000 between spouses each year for tax purposes. It was one of Prime Minister Stephen Harper’s key promises during the 2011 election, but it was contingent on a balanced budget.

Although Tuesday’s federal budget predicts a $6.4-billion surplus in 2015, Flaherty is now questioning the use of putting some of that money toward the tax loophole.

The income-splitting promise has had its share of critics who say that it’s merely a tax break for couples who are well-off.

“What’s interesting about income splitting when you study family dynamics in Canada is that it’s only really the sole earner households that make the biggest benefit,” David Macdonald, a senior economist with the Canadian Centre for Policy Alternatives, told CTV’s Power Play Wednesday.

“If you’ve got two people that make about the same amount, there’s no benefit there. If you’re a single mother, there’s no benefit there because there’s no one to split with. And so, the wealthiest families are usually the ones that have a single earner, that you could live off that income, and that’s where you end up seeing all the tax breaks going.”

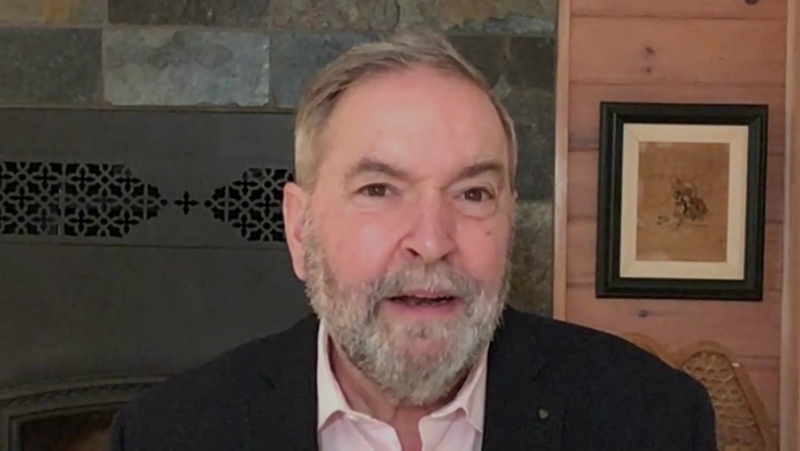

Opposition Leader Thomas Mulcair asked Harper on Wednesday if he agreed that income-splitting would provide no relief to the vast majority of Canadian families.

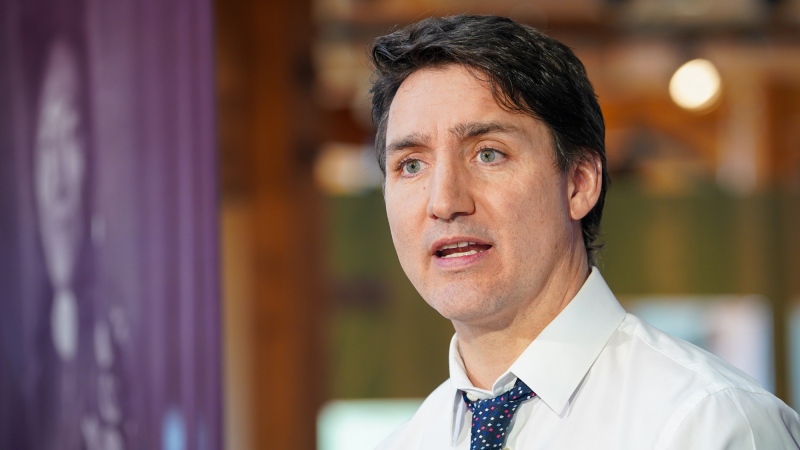

Harper replied: "This government said in the last election, made a commitment, that when we balance the budget ... one of the highest priorities of this government will be tax reduction for Canadian families.”

Treasury Board President Tony Clement and Employment Minister Jason Kenney said they back income-splitting, while Maxime Bernier, minister of state for small business, seemed to side with Flaherty.

Industry Minister James Moore did not answer directly when asked about income-splitting. "You're talking about 2015. We have to get through 2014 first," he said.

The C.D. Howe Institute, a public policy think-tank, has said that 85 per cent of households, including single-parent families, would gain nothing from income-splitting. It also estimated that 40 per cent of total benefits would go to families with yearly incomes above $125,000.

Macdonald said that, according to Canadian Centre for Policy Alternatives’ calculations, the top five per cent of the richest families would get the same benefit from income-splitting as, on average, the bottom 60 per cent of families combined.

“As a general rule of thumb, you can say with income-splitting, the more you make, the bigger your cheque from the government in terms of a tax receipt,” he said.

Earlier Wednesday, Flaherty touted his government’s fiscal plan and the measures outlined in the 2014 budget, saying it’s “the continuation of austerity for the Conservatives.”

Appearing on CTV’s Canada AM, Flaherty said the government needs a contingency fund.

“I want to make sure when we balance that we have a substantial surplus, which we will, next year,” he said.

With files from The Canadian Press