OTTAWA -- Parliament's budget watchdog says the federal government has room to increase spending and still remain financially sustainable over the long run, though the same can't be said for many provinces.

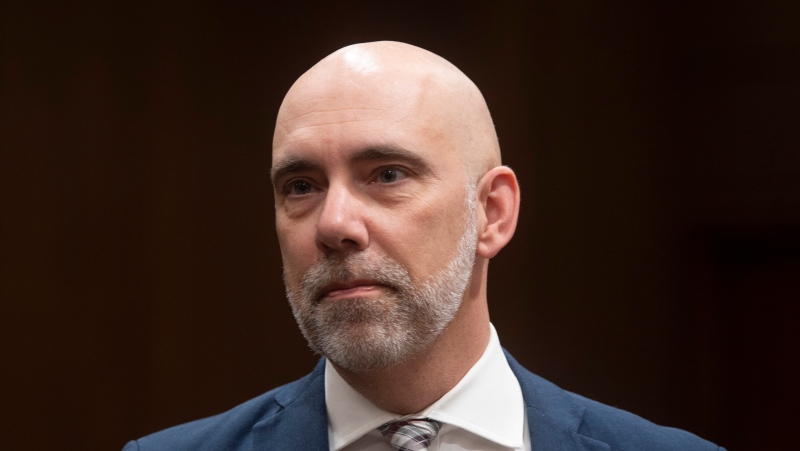

In a new report, parliamentary budget officer Yves Giroux says based on current policies and programs, the federal government could permanently increase spending or reduce taxes by around $41 billion and maintain its current debt-to-GDP ratio over the long term.

"So it has fiscal room," Giroux told The Canadian Press in an interview. "It could increase expenditures or lower taxes by a significant amount -- 1.8 per cent of GDP."

That is likely good news for the Liberal government, which has been criticized by the Opposition Conservatives for ringing up tens of billions of dollars in additional federal debt in recent years even as it looks to introduce a new budget in the next few weeks.

The federal budget will be the first for the Liberals since the fall election, and many eyes will be on whether the government makes good on its promise to start introducing a pharmacare plan for Canadians.

Giroux's assessment only looked at current spending and did not take into account campaign promises.

"Over the long term, under current policies, the federal government is in a sustainable," he said. "But that could change if the government were to change program parameters or go on a spending spree of some kind or establish new programs."

The parliamentary budget officer's findings were less rosy for provinces and territories -- which could put pressure on the federal government to help them out.

"As an aggregate, they have a fiscal gap of 0.3 per cent of GDP, which is about $6 billion," he said. "So provinces and territories, in aggregate again, they'll have to either increase taxes or reduce spending by $6 billion or a combination to be sustainable over the long term."

Even then, some provinces are much better off than others. Manitoba, Saskatchewan, Newfoundland and Labrador as well as New Brunswick and Alberta were all found to be on an unsustainable track while Quebec, Ontario, B.C. and Nova Scotia were in good shape.

"It's due to a combination of increase in social expenditures, mostly health expenditures, and transfer payments favouring some provinces by the nature of their economies or demography and negatively affecting others," Giroux said.

The parliamentary budget officer said an "obvious area" for the federal government to step in and help would be to change the way it transfers money to provinces and territories for programs, which could gobble up some of its own fiscal wiggle room.

Ottawa could also cut federal tax rates, he said, "so that provinces could choose to occupy that tax room by increasing their own tax rates to occupy that or not, depending on the province's preferences."

This report by The Canadian Press was first published Feb. 27, 2020.