Conservatives ask auditor general to review tax-change confusion

The Peace Tower is pictured on Parliament Hill in Ottawa on Monday, Jan. 25, 2021. THE CANADIAN PRESS/Sean Kilpatrick

The Peace Tower is pictured on Parliament Hill in Ottawa on Monday, Jan. 25, 2021. THE CANADIAN PRESS/Sean Kilpatrick

The Opposition Conservatives are asking the auditor general to probe the Finance Department's handling of tax changes that left small business owners and family farmers confused for weeks.

It was a Conservative private member's bill approved by Parliament in late June that rewrote the tax code so owners could sell the family business to relatives at the same tax rate as if they were selling to a stranger.

One day after the bill got parliamentary approval, the Finance Department announced the government would introduce amendments to close potential loopholes and apply the rules on family business sales starting Jan. 1, 2022.

On Monday, hours before a House of Commons committee hearing on the matter, Finance Minister Chrystia Freeland said the new rules were the law of the land and sought to clarify the earlier statement.

In a letter on Thursday, the Conservatives argue a number of questions remain surrounding the government's decision-making process, and ask auditor general Karen Hogan to conduct her own review.

Luc Berthold, the party's Treasury Board critic, writes in the letter that he believes Hogan's office has a key role to play in helping explain what happened.

This report by The Canadian Press was first published July 22, 2021.

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

'One of the single most terrifying things ever': Ontario couple among passengers on sinking tour boat in Dominican Republic

A Toronto couple are speaking out about their 'extremely dangerous' experience on board a sinking tour boat in the Dominican Republic last week.

Half of Canadians have negative opinion of latest Liberal budget: poll

A new poll suggests the Liberals have not won over voters with their latest budget, though there is broad support for their plan to build millions of homes.

opinion Why you should protect your investments by naming a trusted contact person

Appointing a trusted person to help with financial obligations can give you peace of mind. In his personal finance column for CTVNews.ca, Christopher Liew outlines the key benefits of naming a confidant to take over your financial responsibilities, if the need ever arises.

Teacher shortages see some Ontario high school students awarded perfect grades on midterm exams

Students at a high school in York Region have been awarded perfect marks on their midterm exams in three subjects – not because of their academic performances however, but because they had no teacher.

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.

Doctors combine a pig kidney transplant and a heart device in a bid to extend woman's life

Doctors have transplanted a pig kidney into a New Jersey woman who was near death, part of a dramatic pair of surgeries that also stabilized her failing heart.

Photographer alleges he was forced to watch Megan Thee Stallion have sex and was unfairly fired

A photographer who worked for Megan Thee Stallion said in a lawsuit filed Tuesday that he was forced to watch her have sex, was unfairly fired soon after and was abused as her employee.

Ottawa injects another $36M into vaccine injury compensation fund

The federal government has added $36.4 million to a program designed to support people who have been seriously injured or killed by vaccines since the end of 2020.

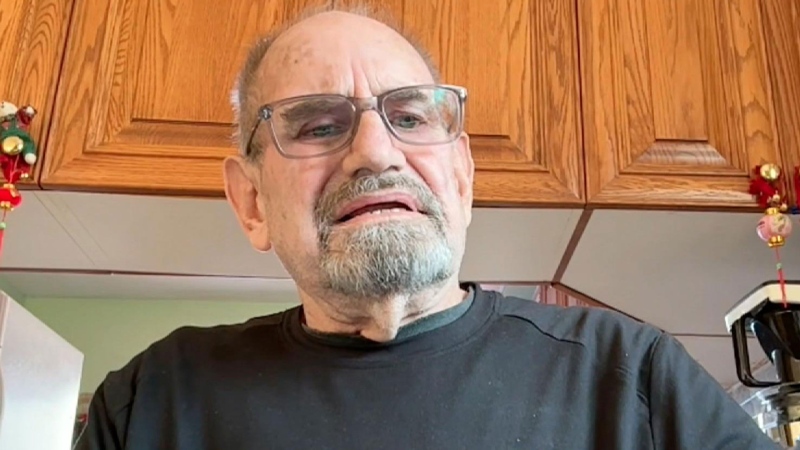

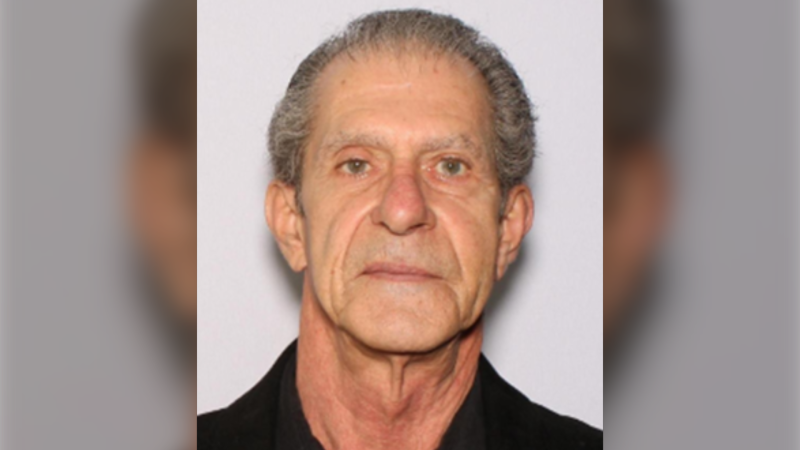

An Ontario senior thought he called Geek Squad for help with his printer. Instead, he got scammed out of $25,000

An Ontario senior’s attempt to get technical help online led him into a spoofing scam where he lost $25,000. Now, he’s sharing his story to warn others.

Local Spotlight

Fergus, Ont. man feels nickel-and-dimed for $0.05 property tax bill

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

Twins from Toronto were Canada's top two female finishers at this year's Boston Marathon

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

Mystery surrounds giant custom Canucks jerseys worn by Lions Gate Bridge statues

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.

'I'm committed': Oilers fan won't cut hair until Stanley Cup comes to Edmonton

A local Oilers fan is hoping to see his team cut through the postseason, so he can cut his hair.

'It's not my father's body!' Wrong man sent home after death on family vacation in Cuba

A family from Laval, Que. is looking for answers... and their father's body. He died on vacation in Cuba and authorities sent someone else's body back to Canada.

'Once is too many times': Education assistants facing rising violence in classrooms

A former educational assistant is calling attention to the rising violence in Alberta's classrooms.

What is capital gains tax? How is it going to affect the economy and the younger generations?

The federal government says its plan to increase taxes on capital gains is aimed at wealthy Canadians to achieve “tax fairness.”

UBC football star turning heads in lead up to NFL draft

At 6'8" and 350 pounds, there is nothing typical about UBC offensive lineman Giovanni Manu, who was born in Tonga and went to high school in Pitt Meadows.

Cat found at Pearson airport 3 days after going missing

Kevin the cat has been reunited with his family after enduring a harrowing three-day ordeal while lost at Toronto Pearson International Airport earlier this week.