WASHINGTON -- The Canadian government used an energy summit in Washington to argue for the continued relevance of the Keystone XL pipeline project in the face of plummeting oil prices.

The plunge has buoyed opponents of Canadian oil here who argue that the new normal in oil prices has obliterated the logic supporting the project.

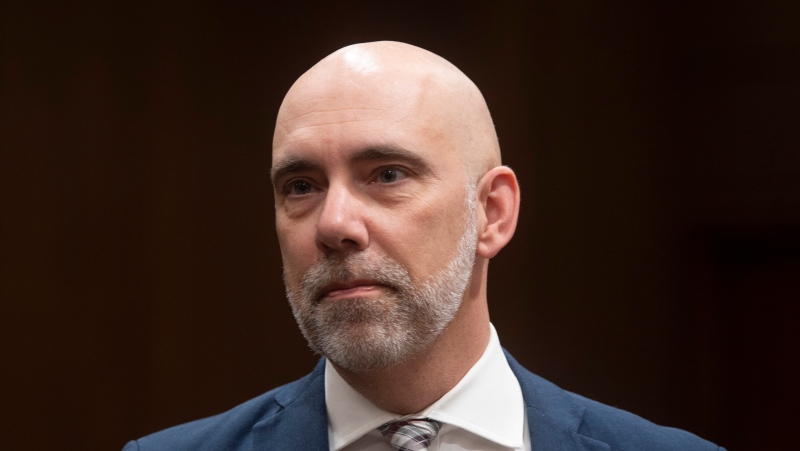

Natural Resources Minister Greg Rickford challenged that argument at a news conference Monday, standing beside his counterparts from the United States and Mexico.

He responded to a question about the viability of Keystone XL by saying infrastructure projects should be decided on longer-term calculations.

"This kind of price volatility reminds us how fragile the global economy still is -- and for Canada's purposes, how close to home it can still impact us," Rickford said.

"Our investment decisions therefore, the policies of our government, are typically made with a view to long-term -- 20- to 40-year -- market expectations. We're equally interested in the cost, averaged-out, over those times."

The question has gained a new urgency, with the economics shifting rapidly and a presidential decision on the controversial project expected early in the new year.

President Barack Obama has declared that greenhouse-gas emissions will guide his decision. Given that yardstick, project proponents like the Canadian government have repeatedly touted a certain finding from a study by his own State Department.

That study found Keystone XL wouldn't affect greenhouse-gas emissions, because Canadian oilsands extraction would grow at a similar rate, with or without the pipeline -- unless two things happened: oil fell below $65-$75 per barrel, and new pipeline plans were blocked everywhere else.

It's all been happening.

Fast-forward 11 months from that January report and, in a turn of events that would have been considered shocking until recently, the price of a barrel of oil is now less than $56, and every major pipeline project from Alberta faces political or legal trouble.

Keystone XL opponents have been drawing attention to that shift. In the last few months, they've begun arguing that the old math no longer applies.

An expert who correctly predicted this year's price plunge said Keystone XL still makes long-term strategic sense as an infrastructure project, but the business case is weakening fast.

Leonardo Maugeri of Harvard's Kennedy Center estimates that planned capital expenditures in Canada's oilsands would drop 15 per cent once oil is below $70 a barrel, with a $10 price spread for Canadian oil.

"Already at (current) prices and costs, Keystone is hardly profitable," Maugeri said Monday. "The problem is that -- in my view -- prices could be even much lower than they are now, given the Saudis' current stance to embrace a prolonged period of low prices just to wipe out expensive oil productions globally.

"Whereas the strategic reasons to build up Keystone are still in place, if Keystone proponents do not succeed in renegotiating costs with suppliers the project will be difficult to pursue."

In his opening remarks Monday, Rickford made brief mention of Keystone XL.

"There are already 70 pipelines safely delivering oil and gas across our borders every day. Naturally, our government thinks that number should grow to 71," he said. "Keystone XL could obviously help independence in secure sources of crude."

His U.S. counterpart, Ernest Moniz, tiptoed around the Keystone XL question, which is politically sensitive in the U.S. It's expected that Obama will make a decision soon after a Nebraska court rules on the constitutionality of the route, or after the new Republican-dominated Congress forces a bill onto his desk.

The Nebraska decision could come as early as Friday.

What Moniz did speak about, more generally, was the need for greater North American co-operation on energy following Mexico's reforms meant to attract foreign investment to its sector.

The ministers agreed to begin co-operating on energy data, statistics and mapping of the North American energy sector. Moniz bemoaned the fact that it had been seven years since ministers from the three countries met in the same place -- something he said shouldn't happen again.

He said better information-sharing is a start.

"You look at a map that shows hurricane risks to the energy infrastructure -- it miraculously ends at the Texas-Mexican border," Moniz said.

"I think our Mexican colleagues know that's not true. And that's just one example."

The Mexican government is loosening its monopoly over the industry, and allowing outside investors to bid on exploration projects. The ministers were given a briefing from Mexican officials on what the reforms might mean for companies from the U.S. and Canada.

One question the ministers also skirted was whether Canada and the U.S. have ever taken any real, serious steps toward regulations for the oil and gas sector.

Prime Minister Stephen Harper had long insisted Canada would move ahead if the U.S. did too, but with no such deal in sight he declared last week that it would be "crazy" to go it alone.

When asked whether they'd ever made any progress on that file, Moniz and Rickford switched the subject to focus on other areas of bilateral co-operation.