TORONTO -- Finding yourself low on cash? Or are you looking for ways to stop wasting money frivolously between paycheques?

Well, one financial expert recommends people try the “30-day money diet” and avoid shopping, using credit cards, social media and eating out for one month.

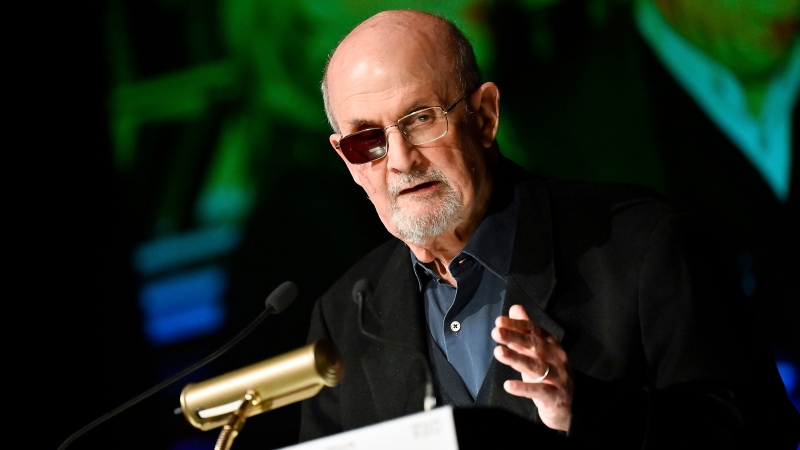

“It’s like a reset,” money strategist author David Lester told CTV’s Your Morning on Thursday. He likened the “30-day money diet” to other popular food diets which focus on eliminating something out of a person’s meals.

Lester, who tried the diet himself during January, said he not only saved 20 per cent from his monthly budget, he actually lost 15 pounds too.

The originator of the diet is Ashley Feinstein Gerstley, founder of the Fiscal Femme blog and author of "The 30-Day Money Cleanse,” who first compared detoxing your bad money habits to eating better.

STEP ONE: NO CREDIT CARDS

The first step involves ditching the plastic in favour of only making purchases with cash. The result, Lester suggests, is being more aware of how much is actually being spent.

Lester said when people swipe their cards for a purchase, or use it to buy something online, they can forget that it’s real money they’re spending. He said people feel they can spend “without any feeling of loss … (and) it’s not real money until you get the bill.”

He recommends that people whip out dollar bills and coins instead of cards whenever they can.

STEP TWO: NO SHOPPING

Lester said that cutting out non-essential shopping is the next big step.

One of the reasons people might shop is boredom, he says, not necessity. And part of avoiding needless shopping is learning to fall in love again with the clothing or items you already have.

STEP THREE: NO EATING OUT

Lester said a huge chunk of many people’s budgets is spent on eating out.

People on the “money diet” will realize early on that they’re saving a pretty penny by eating from groceries they bought or packing a lunch. “Those little credit card charges add up,” Lester said of the coffees, snacks or lunch many regularly buy when they’re out and about every day.

STEP FOUR: NO SOCIAL MEDIA

And finally, Lester encourages people to cut themselves off from sites such as Facebook, Twitter, Instagram because they could be compelling them to spend money to emulate their friends.

“So you just don’t want (to see) those triggers,” he said. Lester also cited studies suggesting people don’t feel happier when they’re so connected to social media.

He urged people take longer walks with their dogs, spend more time with family or volunteer as a way to pass their time -- instead of scrolling through their phone.