Concerns over record-high gas prices are weighing on many, with experts saying Canadians should brace for an expensive summer at the pumps as the price of oil continues to skyrocket thanks to tighter sanctions on Russian oil in response to the country’s attack on Ukraine.

The average price of gas in Canada has reached record levels in recent weeks, with prices climbing to more than $2 in some regions.

Analysts say curbs on Russian oil exports will likely continue to send already soaring oil and gasoline prices higher in Canada, the U.S. and Europe, adding pressure to the global economy and putting further strain on consumers’ wallets.

Unfortunately for consumers, avoiding a surge at the pumps is near impossible. But there are some ways to lessen the impact on your bottom line.

CTVNews.ca spoke to financial experts about what you should and shouldn’t consider when it comes to rising gas prices.

DO: WORK FROM HOME (IF POSSIBLE)

The exponential rise in gas prices has forced commuters to rethink their mileage at a time when many provinces are lifting COVID-19 health restrictions, sending some back to a physical office.

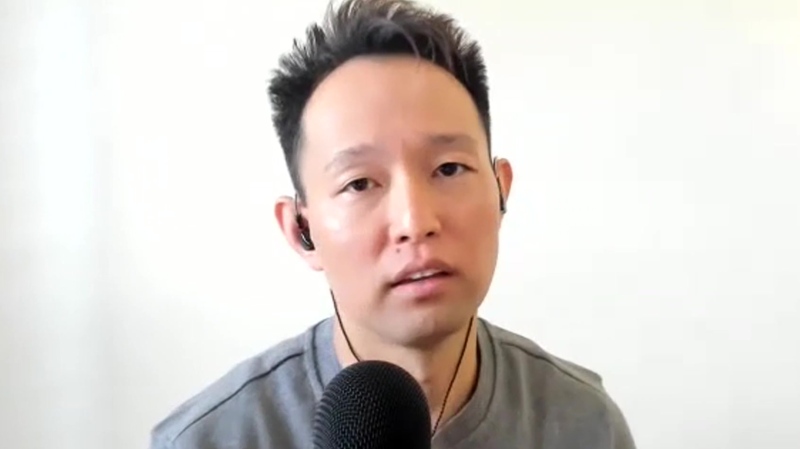

Kelly Ho, a certified financial planner with DLD Financial Group Ltd. based in Vancouver, suggests that those who have the option to request to work from home do so, even if that means reducing your commute by one or two days per week. Other options might include opting for ride-sharing, if it’s available in your community, or turning to public transit.

DON’T: GO LOOKING FOR A NEW VEHICLE, UNLESS IT’S TIME

“I'm not about to sell my vehicle and spend $85,000 to $100,000 to go buy an electric vehicle to save myself however much it is at the pump. It just doesn't make any financial sense,” Ho told CTVNews.ca by phone in March.

But, for those who are already in the market for a new vehicle, Ho says there’s no harm in looking into electric or hybrid options to mitigate the rise in gas prices.

“[But] before committing to buying that electric engage with a professional and make sure you can afford an increase in your fixed expenses. If you see the numbers run ahead of time you may not take that leap.”

DO: ADJUST YOUR BUDGET

Inflation rates are surging at the same time as gas prices, forcing many Canadians to tighten the purse strings when it comes to their monthly budgets.

“The reality is, you either drive less or consume less because that money has to come from somewhere,” Jason Pereira, senior financial consultant with Woodgate Financial Inc. and president of the Financial Planning Association of Canada, told CTVNews.ca in March.

Plus, as Pereira points out, a rise in gas prices has a blowback on other goods transported by truck. That means everything from your grocery bill to your Amazon order is rising.

“When I say you have to cut elsewhere it's doubly important because your base level consumption of groceries and whatever else it is you need to live off of also just went up substantially,” he explained.

When it comes to the areas in which you should cut down on spending, both Ho and Pereira agree it’s entirely up to the individual.

“People will pick on the latte and say ‘skip the Starbucks.’ But if your daily trip to Starbucks is the only thing keeping you sane… it’s cheaper than therapy,” Pereira notes.

“But if there are things that maybe you buy, but don't necessarily make you happy somewhere in your budget, figure out where those are.”

DON’T: STICK YOUR HEAD IN THE SAND

Finally, if you’ve taken the attitude of “this too shall pass” – think again.

As Russia’s attack on Ukraine first unfolded earlier this year, the market began adding a risk assessment to the price of oil. Sanctions on Russian oil compounded that increase.

Despite the fact that Canada did not import any Russian oil in 2020, and imported three per cent of its total crude oil from Russia in 2019, Russia is a major producer on the world stage. That means any volatility towards Russian oil exports makes oil prices rise globally.

While the trajectory of gas prices isn’t entirely predictable, analysts say as long as Russia continues its war in Ukraine, prices will keep climbing.

“Do not put your heads in the sand about this. If you think it’s going to go away tomorrow, it won’t,” urged Pereira.