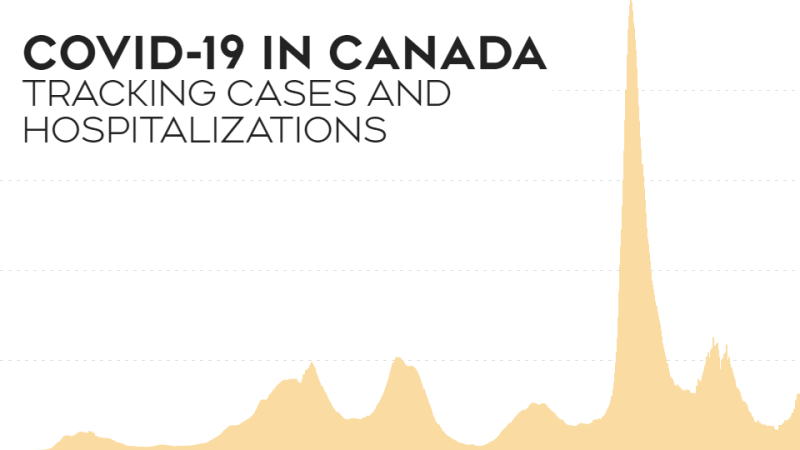

TORONTO -- Governments across the country are spending unprecedented amounts in response to the COVID-19 pandemic – but in doing so, they're only making up a fraction of the damage the novel coronavirus is doing to the Canadian economy.

Parliamentary budget officer Yves Giroux's latest figures, released Thursday, estimate that the various measures to help those affected by the pandemic will add up to nearly $146 billion in new federal government spending.

In an interview on CTV’s Power Play on Thursday, Giroux said the deficit will continue to balloon past the size of the economy itself.

“It’s the largest budgetary deficit on record since the records began being collected this way in the ‘60s,” she said. “It’s something we have never seen in this country.”

If existing shutdowns remain in place through the spring and are gradually lifted over the rest of 2020 while oil prices remain low, Giroux estimates that Canada's real GDP will fall by 12 per cent this year – nearly four times the steepest drop on record. That includes an estimated drop of a little more than $500 billion in the second quarter alone before a slow recovery period begins.

"We're nowhere near back, even by the end of this year, where we were in the first quarter of 2020. It'll take us two years even just to get back to those levels of nominal GDP," Kevin Page, a former parliamentary budget officer, told CTVNews.ca via telephone Thursday from Ottawa.

"That's just an unbelievable adjustment. We've not seen anything like that before."

Giroux's numbers are only estimates of what could happen in one of many scenarios. It's possible that the spread of the virus will be slowed enough that society can reopen faster than expected, or that a second wave of COVID-19 cases will require reopened businesses to once again close. The latter scenario would likely result in the emergency benefits being extended, increasing their costs.

"Governments are well-known for keeping programs alive longer than maybe they need to, but at the same time we don't know how this recovery is going to go. We may find that some of these programs need to become permanent. There are still a lot of unknowns," Lindsay Tedds, an associate professor of fiscal and economic policy at the University of Calgary, told CTVNews.ca Thursday via telephone.

A DEEPER PROBLEM

But it isn't just the federal government that will find itself with big bills to pay once the pandemic ends. The provinces and territories are partnering with the feds on some of their programs, and running some of their own. Page estimates that provinces that had balanced budgets may well slide into the red as a result, while those that were already spending more than they were taking in may see those deficits.

"Their deficits are going to double and triple, so their debt is going to go up as well. That will need to be financed," he said.

Nor are local governments immune. Municipalities are facing lost revenue in everything from deferred property taxes to transit fees.

The Federation of Canadian Municipalities publicly asked the federal government last week for $10 billion to $15 billion in emergency funding, which president Bill Karsten says should be enough to replace six months' worth of lost municipal revenues across the country.

"Something has to give. If we don't get this minimum $10 billion … hard decisions have to be made," Karsten told CTVNews.ca via telephone Thursday from Halifax.

Many municipalities have already started making some of those hard decisions. Halifax, where Karsten is a councillor, has laid off 1,500 casual, temporary and seasonal workers. Other local governments have also looked to layoffs, or scaled back services, or both.

Karsten describes the situation as a crisis, noting that while the federal and provincial governments can use debt financing to get through downturns, the laws governing municipalities prevent them from doing the same.

"It's not like saying 'we'll just borrow the money.' Our books need to be balanced," he said.

Long-term cuts could also be difficult for municipalities to handle, Karsten said, as many of their services – which include water supply, emergency services, garbage collection and road maintenance – are seen as necessary.

"Those have to continue regardless of how life might change under COVID," he said.

SO WHAT'S THE ANSWER?

When the federal government is spending more money than it is taking in, it ultimately has three options: tamping down spending, increasing revenues, or taking on more debt.

All three are politically unpalatable in different ways. Voters don't like tax increases, don't want to lose out on programs and services they're already accessing, and worry about passing on escalating debt bills.

In this situation, though, the government will have to pull some combination of these three levers to make up for the sudden and unexpected increases in spending brought on by emergency COVID-19 relief programs. With interest rates at some of their lowest levels ever, many economists say borrowing and spending – in the form of a major economic stimulus package aimed at improving the nation's infrastructure – is the best way to lead Canada's economy to a proper recovery.

"The feds are going to have to come out … with something that signals the architecture of a stimulus package – and they can't lowball it. It needs to be big," Page said.

Further aiding Canada's ability to pull this off, Page said, is the country's low debt-to-GDP ratio. The Trudeau government has regularly defended the escalating national debt by noting that it is shrinking relative to the economy's overall growth. Many developed countries have much higher debt-to-GDP ratios, meaning further borrowing would strain their economies much more than it would Canada's.

"It would be a shame if we immediately, at the end of this pandemic … that people say 'OK, now we've got to hit the brakes on spending, we need to get back to some lower debt-to-GDP ratios,'" Page said.

If infrastructure spending is the solution the government decides on, then Karsten says municipal governments will be happy to help see the projects through, much as they did during the post-recession stimulus blitz of the late 2000s.

But is that the form a stimulus package should take? Physical infrastructure projects tend to create jobs that mostly benefit male workers with skilled trades backgrounds, and some advocates argue that women, students and less-skilled workers are being disproportionately affected by Canada's response to the pandemic. Tedds argues that a stimulus program should thus look for ways to specially help workers in those groups.

"Our stimulus programs have to think more about the types of people rather than the types of sectors that were hit," she said.

"To simply roll out our usual shovel-ready infrastructure programs – that's not going to benefit the people who were most impacted by this."

Additionally, some sectors may look to the recovery period as a time to accelerate their moves toward automation – potentially improving their productivity but reducing the numbers of workers they need.

Tedds likens it to what Alberta's major oil-and-gas employers did following the 2015 oil price collapse.

"It doesn't necessarily mean fewer jobs, but it does mean potentially very different kinds of jobs that will come back online," she said.

There could also be a major shift in the federal-provincial relationship. Page foresees the potential for that to happen as provinces look for ways to get out from high debt loads.

"This is going to drive, by necessity, a fiscal federalism, managing-the-federation-style conversation that we haven't seen since probably the 1990s," he said.

Over the past month-plus, the government has publicly been focused on the pandemic to the exclusion of almost everything else. Page said that is understandable, given the significant public health risk it represents, but he hopes to see a conversation about economic recovery begin soon, especially with millions of Canadians having had their jobs affected and being left unsure and anxious about what the future holds.

"Consumers' behaviours are changing. People are afraid," he said.

"If they could start telling people that it's coming, I think it would lift people's spirits – and Canada can afford it."