Toronto police arrest several people at rail line protest

Several people have been arrested at a pro-Palestinian demonstration in the city’s west end that has been blocking rail lines for hours.

CTV News Channel is Canada's 24-hour all-news network, drawing on the vast resources of Canada's #1 news organization, CTV News, to deliver breaking news the moment it happens.

Watch the latest headlines from Canada and around the world from CTV News crews based in every major Canadian city.

Stay on top of the latest political news with CTV News Channel's Power Play. The marquee political program with Vassy Kapelos airs daily, Monday to Friday.

Weeknights 5-6 P.M. ET

Don't miss an episode of CTV's Question Period, the national political landmark show with Vassy Kapelos. The program is a must-see for political junkies.

Sundays 11 A.M-12 P.M. ET

Several people have been arrested at a pro-Palestinian demonstration in the city’s west end that has been blocking rail lines for hours.

A Celebrity Apex cruise to the Caribbean this month turned into a rocking Newfoundland kitchen party when hundreds of people from Canada's easternmost province happened to be booked on the same ship.

A defence lawyer for Ibrahim Ali, who was convicted of first-degree murder of a 13-year-old girl in Burnaby, B.C., says the man wants to appear at his sentencing hearing by video over fear for his safety.

An inmate who escaped from Dorchester Penitentiary in Dorchester, N.B., on Saturday evening has a long history of violent crimes and a history of escaping custody.

Toronto police say they have laid 54 charges against three suspects following a carjacking investigation.

A Quebec Superior Court judge has authorized a class-action lawsuit against 16 pharmaceutical companies that are alleged to have misled consumers about the efficacy and dangers of opioid medications.

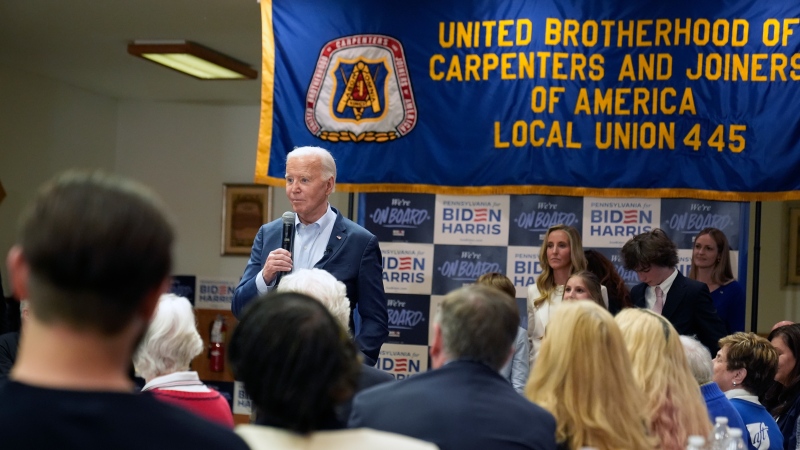

President Joe Biden made a nostalgic return to the house where he grew up in working-class Scranton on Tuesday, kicking off three days of campaigning across Pennsylvania by calling for higher taxes on the rich and casting Donald Trump as an out-of-touch elitist.

The first seven jurors for Donald Trump's hush money trial were seated Tuesday after lawyers grilled the jury pool about their social media posts, political views and personal lives to decide who can sit in fair judgment of the former president.

UN Secretary-General Antonio Guterres is calling for 'urgent de-escalation' of hostilities in the Middle East.

Defiant and determined, House Speaker Mike Johnson pushed back Tuesday against mounting Republican anger over his proposed U.S. aid package for Ukraine, Israel and other allies, and rejected a call to step aside or risk a vote to oust him from office.

The British government's plan for a landmark smoking ban that aims to stop young people from ever smoking cleared its first hurdle in Parliament on Tuesday despite vocal opposition from within Prime Minister Rishi Sunak's Conservative Party.

Australia's prime minister said Tuesday a French construction worker who confronted a man who stabbed six people to death in a Sydney shopping mall is welcome to stay in the country as long as he likes.

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

From plans to boost new housing stock, encourage small businesses, and increase taxes on Canada’s top-earners, CTVNews.ca has sifted through the 416-page budget to find out what will make the biggest difference to your pocketbook.

Small- and medium-sized business owners are set to receive a long-awaited refund from Ottawa, which was holding onto billions of dollars while it sorted out a way to deliver them their carbon pricing rebates.

For years, conventional wisdom in fitness culture has promoted the belief that stretching to become more flexible leads to better movement and injury prevention.

The strain placed on Canadian health care during the COVID-19 pandemic shows no sign of abating, and the top official of the Canadian Medical Association (CMA) is warning that improving the system will be a 'slow process' requiring sustained investment.

A group of doctors say Canadian cancer screening guidelines set by a national task force are out-of-date and putting people at risk because their cancers aren't detected early enough.

Astronomers have spotted the most massive known stellar black hole in the Milky Way galaxy after detecting an unusual wobble in space.

NASA confirmed Monday that a mystery object that crashed through the roof of a Florida home last month was a chunk of space junk from equipment discarded at the International Space Station.

The first human to experience what’s now known as the “overview effect” was Soviet astronaut Yuri Gagarin, who became the first person to view our planet from space a little over 63 years ago.

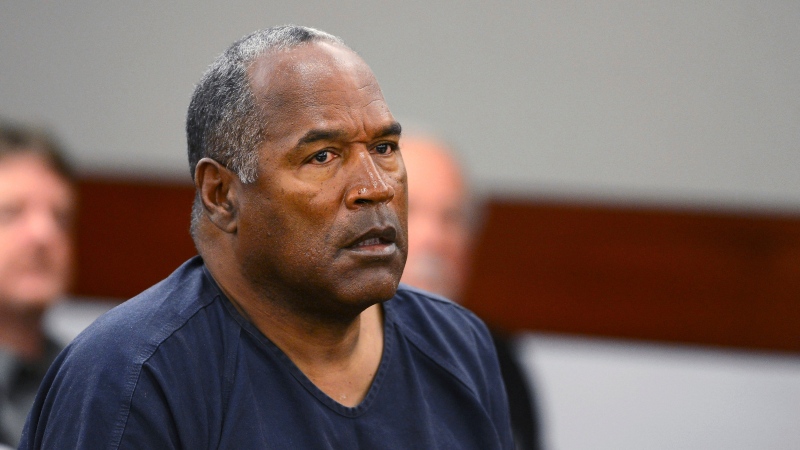

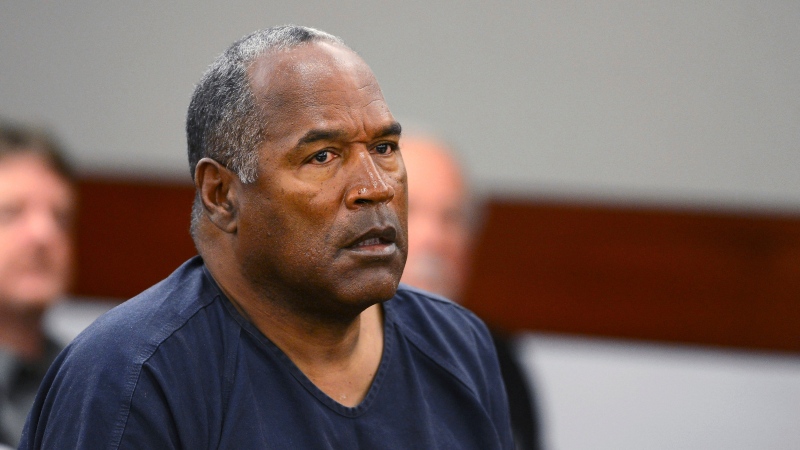

O.J. Simpson's last robust discussion with his longtime lawyer was just before Easter, at the country club home Simpson leased southwest of the Las Vegas Strip. About a week later, on April 5, a doctor said Simpson was 'transitioning.'

Courtney Love has a new radio show about women in music, but she is not much of a fan of several of the biggest female artists of our time.

While her marriage to Gerry Turner didn’t last long, Theresa Nist sounds like she is left with gratitude.

Unifor says it’s temporarily withdrawing its applications to represent workers at two Vancouver-area Amazon facilities, accusing the e-commerce giant of providing a “suspiciously high” employee count.

Shoppers Drug Mart is facing a proposed class-action lawsuit by current and former franchise owners at the retail chain who allege parent company Loblaw engaged in corporate practices that placed them in an “irredeemable conflict of interest” and put patient care at risk.

Tim Hortons is launching flatbread pizzas nationally in a bid to pick up more afternoon and evening customers.

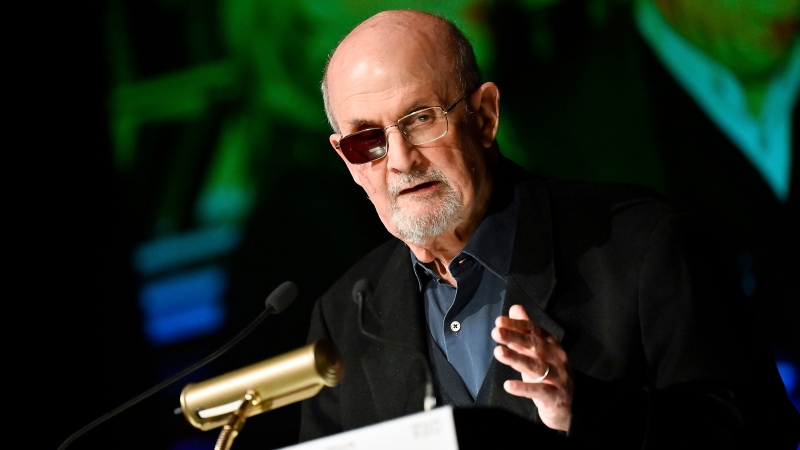

In Salman Rushdie's first book since the 2022 stabbing that hospitalized him and left him blind in one eye, the author wastes no time reliving the day he thought might be his last.

A Celebrity Apex cruise to the Caribbean this month turned into a rocking Newfoundland kitchen party when hundreds of people from Canada's easternmost province happened to be booked on the same ship.

The one thing 9-year-old Cal Clifford wanted more than anything since he was a toddler was a pet octopus.

O.J. Simpson's last robust discussion with his longtime lawyer was just before Easter, at the country club home Simpson leased southwest of the Las Vegas Strip. About a week later, on April 5, a doctor said Simpson was 'transitioning.'

One of the nation's most beloved and decorated curlers, Glenn Howard, officially announced his retirement on Tuesday.

Three teenagers were arrested in connection with a pair of alleged hazing incidents on a Manitoba hockey team, police say.

Tesla has hit a series of roadblocks, including increased competition and declining sales. The company announced Monday it is slashing 10 per cent of its global workforce.

A driver from London will have to find alternative transportation after an OPP officer clocked them travelling nearly 200 km/h on Highway 401 over the weekend.

General Motors will move its Detroit headquarters to a new downtown office building next year and work to redevelop its iconic home along the Detroit River, company and city officials confirmed Monday.