On a day when Canada’s stock market reached an all-time high, shares of cannabis companies continue their downward spiral.

Edmonton-based Aurora Cannabis is the latest producer to report disappointing financial results. Its sales of recreational weed was down 33 per cent compared to last quarter.

With investor pressure mounting, companies like Aurora are cutting costs where they can.

To save $190 million in planned expenses, the company announced it was halting construction of one production facility in Medicine Hat, Alta. and stopping work at another facility.

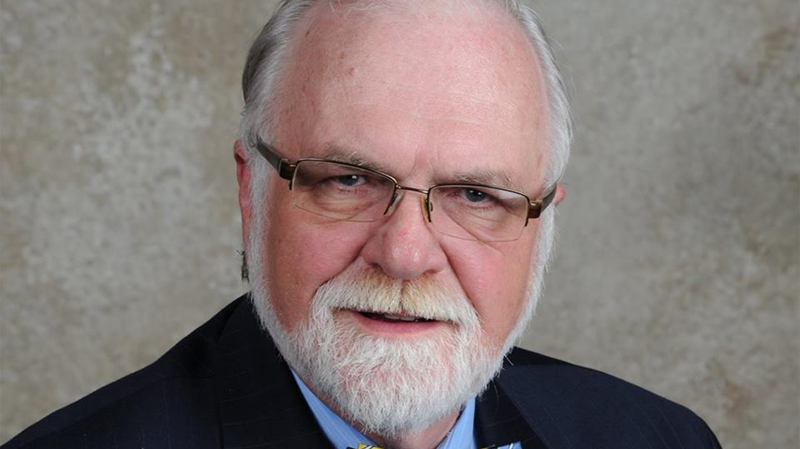

In Montreal, Aurora Cannabis chairman Michael Singer told BNN Bloomberg, “we are tightening the belt and being very cautious about spending."

For the cannabis industry, it’s been a dramatic shift from the abundant investment hype seen during the last year’s lead up to legalization.

Cutbacks are being felt in communities such as Ontario’s Niagara Region, where layoffs by cannabis company Hexo have affected the town of Lincoln. The company cut 200 jobs last month, which is nearly a quarter of its entire workforce.

The selloff in Canada’s five biggest pot stocks has wiped out $33 billion in market value since May.

One of the largest driving factors is the government’s unsuccessful battle with the black market, companies burning through cash and the slow rollout of legal pot stores in markets such as Ontario.

'SOME OF THESE GUYS ARE GOING TO DISAPPEAR'

Industry analyst Andrew Kessner at equity research firm William O'Neil told BNN Bloomberg, “We don't think they're going to be able to raise money easily going forward. And ultimately some of these guys are going to disappear.”

Elsewhere in Ontario, Mississauga-based producer Green Organic Dutchman shares fell sharply following a $20.1 million third-quarter loss.

There have also been some self-inflicted, regulation issues facing some producers. Former high-flyer CannTrust was targeted by Health Canada for growing some cannabis before securing a licence.

Other types of problems are mounting for fellow producers.

During a call with analysts, Mark Zekulin, the CEO of Canopy Growth Corp. said it's "increasingly unlikely" Canopy would achieve its target of $250 million in revenue in its fiscal fourth quarter, which ends in March.

Zekulin also told BNN Bloomberg his company misread the market for new products like cannabis oils and gel capsules.

"The reality is we expected this might be 20 per cent of the recreational market. It ended up to be somewhere along the lines of five per cent,” he explained.

But the industry's positive spin to this current slump is the upcoming “Cannabis 2.0" -- the moniker for the rollout of things like cannabis gummies, oils and other edibles -- which companies hope provides more growth.

New regulations for cannabis edibles and topicals came into effect last month, but because of the approval process products won’t hit the legal market until mid-December -- at the earliest.

With files from The Canadian Press