TORONTO -- As we usher in another decade, a number of new laws and rules will come into effect in 2020 that may have an impact on your way of life. That includes changes to federal divorce laws, as well as cannabis and vaping regulations in some provinces.

Here are the highlights you need to know:

CANADA-WIDE

Federal tax changes

The basic amount most Canadians can earn tax-free is going up on Jan. 1, to $13,229. The increase is being phased in over four years until it reaches $15,000 in 2023.

For Canadians in the lower income brackets, the changes could result in tax savings of up to $140 in 2020. For those earning more than $150,473 annually, those savings will be clawed back or not offered at all.

Also starting on Jan. 1, the employment insurance premiums for individual workers and employees will slightly decrease. The maximum annual EI contribution for a worker will fall by $3.86 to $856.36 and employers' maximum contribution will fall $5.41 to $1,198.90 per employee.

Changes to the Divorce Act

Federal laws related to divorce proceedings and family orders were amended with the passage of Bill C-78, with the majority of changes to the Divorce Act coming into effect on July 1, 2020.

The changes include updated criteria to determine a child’s best interests in custody cases, as well as measures to address family violence when making parenting arrangements.

The changes also aim to make the family justice system “more accessible and affordable” for everyone involved.

The Divorce Act applies to married couples who are divorcing, while provincial and territorial legislation applies to all other spousal separations, including those involving unmarried and common-law couples.

Overhauling the Indigenous child welfare system

Legislation known as the Act Respecting First Nations, Inuit and Métis Children, Youth and Families will come into full force on Jan. 1, 2020. It is meant to overhaul Canada’s Indigenous child welfare system, which critics have for years described as inadequate and discriminatory.

The changes to the legislation were developed with input from the Assembly of First Nations and experts across the country, and AFN says the new rules are “consistent” with the UN Declaration on the Rights of Indigenous Peoples.

BRITISH COLUMBIA

Minimum wage increase

As of June 1, 2020, the minimum wage in the province will increase to $14.60 per hour, from the current hourly rate of $13.85. In June 2021, the minimum wage is expected to increase to $15.20 per hour.

New vaping regulations

The province is planning to roll out much tougher rules when it comes to sale and promotion of vaping products in the wake of increasing concerns about the health effects of vaping.

Among the new rules: the provincial sales tax on vaping products will increase significantly on Jan. 1, from seven to 20 per cent.

No more health-care premiums

B.C. is eliminating the provincial health-care premiums for its residents as of Jan. 1. The government says the elimination of the Medical Service Plan premiums will save individuals up to $900 and families up to $1,800 per year.

ALBERTA

New carbon tax

The federal government will start imposing its carbon tax on Alberta on Jan. 1. Albertans will pay $20 per tonne of CO2 until April 2020, when the price will rise to $30 per tonne.

This means that Albertans will now be eligible for the carbon tax rebate when they file their income taxes. The rebate amounts will be as follows:

Single adult or first adult in a couple: $444

Second adult in a couple or first child of a single parent: $222

Each child under 18: $111

Baseline amount for a family of four: $888

Property division changes under family law

On Jan. 1, certain changes to the provincial family law will make it easier for unmarried partners to divide their property if they break up.

The Matrimonial Property Act will be amended to apply to both “adult interdependent partners” and legally married spouses. Other changes to the Act include clarifying property division rules and when couples can enter into property ownership and division agreements.

SASKATCHEWAN

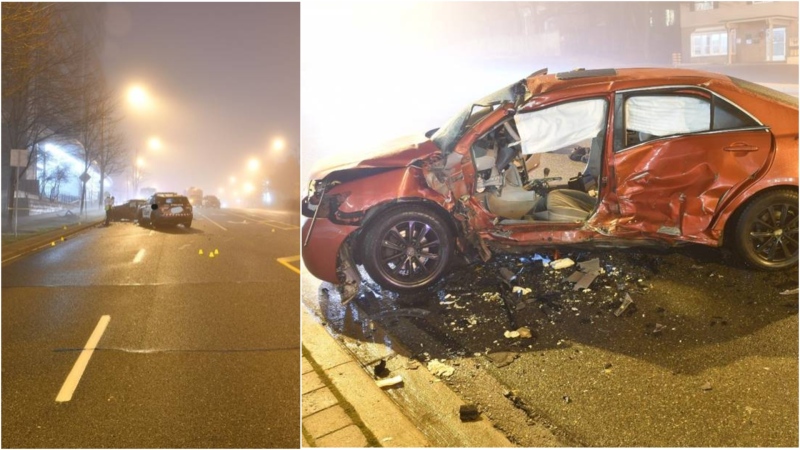

Big fines for distracted driving

Starting on Feb. 1, 2020, the province will significantly increase fines for distracted driving.

Fines for first-time offenders will more than double from the current $280to $580. A conviction will also cost the driver four demerit points.

A second distracted driving offence within the same year will cost $1,400, four demerits and an immediate week-long vehicle seizure. A third offence within the same year will cost the driver $2,100.

Changes to federal carbon tax rebates

The federal government has adjusted the carbon tax rebates for residents of provinces that have not adopted their own carbon pricing models. For Saskatchewan, the 2020 rebates, which must be claimed on the 2019 income tax returns, are as follows:

Single adult or first adult in a couple: $405

Second adult in a couple or first child of a single parent: $202

Each child under 18: $101

Baseline amount for a family of four: $809

MANITOBA

Changes to federal carbon tax rebates

For Manitoba residents, the 2020 federal carbon tax rebates, which must be claimed on 2019 income tax returns, are as follows:

Single adult or first adult in a couple: $243

Second adult in a couple or first child of a single parent: $121

Each child under 18: $61

Baseline amount for a family of four: $486

ONTARIO

No more out-of-country health insurance coverage

The Ontario government’s move to scrap its out-of-country health insurance takes effect on Jan. 1. This means that Ontarians who fall ill while travelling can no longer claim the $400-a-day maximum coverage for inpatient emergency care and the $50-a-day maximum allowed for emergency outpatient services (such as an MRI or a CAT scan) that, until now, were provided by OHIP.

The provincial government has defended its decision by saying that the OHIP coverage was minimal and “inefficient,” given the high cost of medical care abroad – and especially in the United States -- that usually requires private travel insurance.

E-scooters on roads

As part of a five-year pilot project, the Ontario government will let municipalities decide whether to allow e-scooters on their roads.

Operating e-scooters is currently only allowed on private property in the province.

The pilot project starts on Jan. 1. E-scooter drivers will have to be at least 16 years old and wear a helmet.

Restrictions on advertising vaping products

On Jan. 1, Ontario will ban the promotion of vaping products in convenience stores and gas stations, in response to growing concerns about the health effects of vaping on young people.

The province will still allow vaping to be promoted in specialty stores and cannabis shops, which are only open to those aged 19 and older.

Dogs on restaurant patios

Starting Jan. 1., Ontario will give restaurants and bars the option to allow dogs on their patios, in areas where “low-risk foods” (such as pre-packaged snacks and beer) are served. The move is part of a slew of changes enacted by the passage of Bill 132, also known as the Better for People, Smarter for Business Act.

Changes to federal carbon tax rebates

For Ontario residents, the 2020 federal carbon tax rebates, which must be claimed on 2019 income tax returns, are as follows:

Single adult or first adult in a couple: $224

Second adult in a couple or first child of a single parent: $112

Each child under 18: $56

Baseline amount for a family of four: $448

QUEBEC

Legal age for cannabis

As of Jan. 1, the minimum legal age to possess or purchase cannabis in Quebec will be raised to 21. That will make it the highest legal age to purchase cannabis in Canada, compared to a legal age of 19 in the majority of the country.

‘Values test’ for immigrants

Starting on Jan. 1, economic immigrants who want to settle in Quebec will have to pass the province’s controversial “values test.” The test will include questions about secularism in Quebec, religious symbols, same-sex marriage and gender rights.

The test will not apply to newcomers who are refugees or arriving in Canada via family reunification programs, since they come under the federal government’s jurisdiction.

NEW BRUNSWICK

No more annual motor vehicle inspections

As of Jan 1., the province will no longer require drivers to get their personal vehicles inspected every year. Instead, the inspections will be required every two years. The cost of inspecting a vehicle will also go up, from $35 to $45.

NOVA SCOTIA

Changes to income assistance

On Jan. 1, the province will implement changes that will increase the amount of money people on income assistance receive. The increase will vary from two to five per cent, depending on the recipient’s living situation and family size.

The change is a result of a new “Standard Household Rate” that replaces personal and shelter allowances for people on income assistance.

Plastic bag ban

Nova Scotia will join several other provinces in banning most single-use plastic bags at store checkouts next fall. Retailers will still be allowed to use the bags for live fish and bulk items, and there will also be exemptions for food banks and charities.

The ban will come into effect on Oct. 30, 2020.

Ban on flavoured e-cigarettes

Nova Scotia has previously announced that it will be the first province to ban sales of flavoured e-cigarettes and vaping juices as part of regulatory changes that take effect April 1, 2020.

NEWFOUNDLAND AND LABRADOR

Plastic bag ban

The province will join Nova Scotia and Prince Edward Island in banning retail plastic bags. While no exact date of enforcement has been set for the ban, the provincial government says that, by mid-2020, shoppers should bring their own reusable bags to grocery stores and other retailers.

New rules to address workplace harassment

The province’s expanded regulations regarding workplace harassment take effect Jan. 1. The changes include new training requirements for employers and employees, as well as “a secure and confidential means” for employees to file harassment complaints.

With files from The Canadian Press