Canadians denied a mortgage from big banks still have a path to homeownership, says one expert covering alternative lenders.

The pressure on mortgages comes as the Bank of Canada increased rates to 4.25 per cent, a level not seen since 2008. It is the seventh rate hike in nine months as inflation remained high at 6.9 per cent in October, according to Statistics Canada.

In the aftermath, some trying to buy a home are being turned away from traditional banks, no longer qualifying for mortgages. That leaves private lenders as an option for people hoping to buy a home soon.

Big Canadian banks are often referred to as "A-lenders" while others, including credit unions and trust companies, are called B lenders.

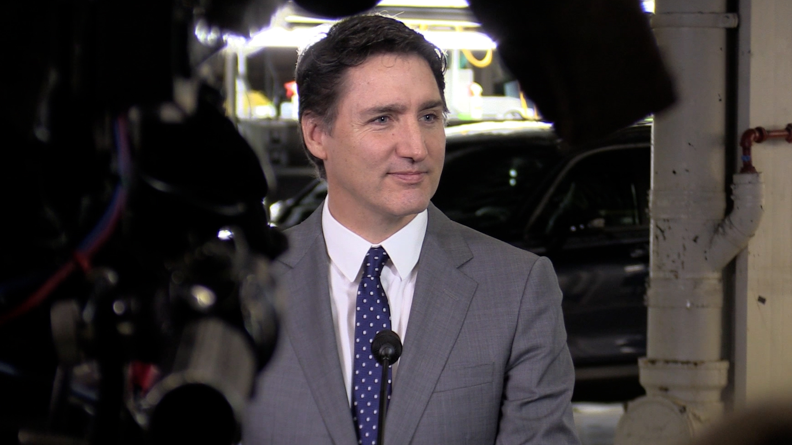

"B lenders are trending these days as the number one option for getting a mortgage if you're turned down by your bank," Grant Powell, a mortgage expert from British Columbia, told CTV's Your Morning on Thursday. "They are smaller lenders, but many are still national. Many have been in business for decades (and) they work with you on a case-by-case basis."

B lenders are smaller companies with lower standards to qualify for a mortgage. Powell says this is attractive for people who need more flexibility and may have inconsistent credit, debt, or employment.

"The downside is they do require at least a minimum 20% down payment," Powell said. He noted they often have higher interest rates than traditional banks and have a "lender fee" of 1 to 2 per cent.

Private lenders can be family members or businesses.

"These lenders are flexible, but the interest rates are a lot higher," Powell said of private lenders. "And it's usually…with a short-term basis, it's not a permanent solution."

Powell advises anyone turning to a private lender to have an "exit strategy."

"You are paying higher interest rates and you're charged the fee for placing the loan from two to 5 per cent of the mortgage amount," he said. "So make sure you do have an exit strategy because you only want to be in this kind of loan for I'd say one, two — maximum three years."

Vendor take-back mortgages are popular in commercial spaces and deals, Powell said. They allow the seller to give the buyer a two- to five-year loan for the partial purchase price.

"It's good for the seller, because they can actually sell the place and (it's) good for the buyer because they can get into a place sooner because they don't have to come up with as much down payment," Powell said.

The downside is that the seller needs to be a part of the purchase to ensure they receive their money back.

Powell said prospective homebuyers need to verify the agreement by a mortgage broker when interacting with other lenders.

Click the video at the top of this article to hear more alternatives from Powell.