OTTAWA -

The Canada Revenue Agency will begin accepting income tax returns Monday, marking the official start of tax-filing season.

The agency cautions it will be another "unique" tax period as it continues to face challenges due to the COVID-19 pandemic.

But the CRA says it has not extended the tax filing deadline, which remains April 30 for most Canadians, though because the deadline falls on a Saturday this year, returns filed by May 2 will be considered on time.

The federal tax collector says Canadians need to file their income tax returns so they can receive benefits and credits they may be entitled to.

Canadians who worked from home may be eligible to claim a deduction of up to $500 for home office expenses using a temporary flat rate method.

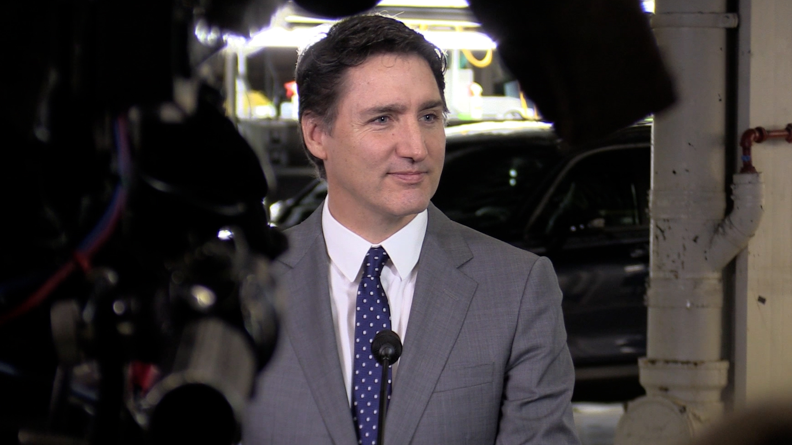

National Revenue Minister Diane Lebouthillier says she's proud of the way the CRA has responded to challenges during the pandemic, noting that the agency's employees have gone "above and beyond" in administering COVID-19 benefits.

"I can assure Canadians that this is a strong team that is there to help them file their returns so that they receive the benefits and credits they are entitled to," she said in a statement.

This report by The Canadian Press was first published Feb. 21, 2022.