HUNTSVILLE, ONT. -- It's happening: the tax refund cheques are in the mail.

Now to be clear, I'm never thrilled when I get a tax refund, because that means the government has had use of my money interest-free for the past year instead of me.

Having said that, if I do get a refund, I want to make up for lost time and get the biggest bang from my tax refund buck and put that money to work for me.

To begin, I always suggest you look at your finances on an annual basis as a whole. We do that by completing our net worth statement. We list everything we owe and everything we own to get a good picture of where we stand financially. From the net worth statement, we set our financial goals for the year.

Here is how we do that:

We will look to see what debt we have and the interest rate charged on it, how much we have sitting in cash, and what sort of returns we are getting on our investments. We also discuss our big family purchases and how they will be paid for. We look at our goals for the short term, medium term and long term.

These numbers may shift a little because every year we revise our plan according to our needs, wants, costs and returns. Plans aren't carved in stone; they're simply simply a road map to our financial destination. Detours happen all the time.

However, planning like this is a very tangible way to allocate money you have coming in via extra income, bonuses, gifts or tax refunds.

Our goal every single year is to improve our net worth. I hope you do too. You improve your net worth by paying down debt, building up your investment portfolio, increasing your home value with smart home investments, and even cutting costs to free up money.

Here are a few options:

- Pay down your expensive debt, such as credit cards or lines of credit. This will reduce interest charges and help you to build a better credit score.

- Depending on your mortgage rate, which in all likelihood is ridiculously low, you might consider investing extra money in the markets via either a TFSA or RRSP. Both are great plans, but remember that the effectiveness of the plan is in the investments held within the plan. Don't just sit in cash. Both plans have their own favourable tax treatments, meaning more money in your pocket to redeploy.

- Consider investing your child's future in an RESP, and benefit from the Canada Education Savings Grant. This way, you get free money from the government.

- Drill down on every single expense you have and where you can cut costs, renegotiate premiums and eliminate any duplication. Redirect the savings towards a goal that matters to you.

- Create additional value in your home by switching to energy-efficient appliances, or add new insulation in the attic to help save on utility bills. If your mortgage is at least two percentage points higher than a return you can get on your investment, consider making an additional mortgage payment that can help save on interest, pay down the principle and reduce the amortization.

Jackie Porter, a certified financial planner in Toronto, reminds us "above all, this year has taught us how vital it is to have an emergency fund. If you don’t have enough reserve to pay your bills if something unexpected happens, money in locked investments won’t help you. I always recommend three months of monthly expenses be set aside, so if you don’t have enough money in a savings account, that’s where your refund should go.”

The above are examples of what I would do with a tax refund. In a recent survey by IG Wealth Management, they found that 35 per cent of Canadians will save or invest the money, 32 per cent plan to pay off debts, 14 per cent will use the money to travel, and 11 per cent plan to spend their money on a home renovation. I like all of these. They're all productive uses of your money

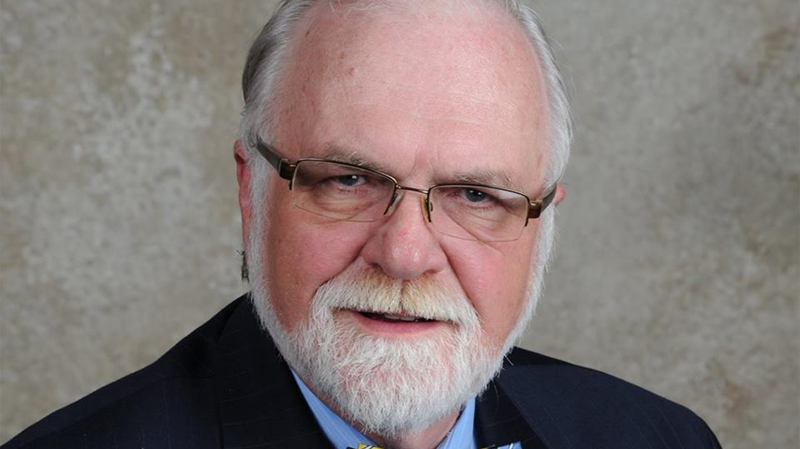

Promise yourself that this is the last year you get a tax refund and adjust your deductions accordingly. You work hard for your money, and now is the time to ensure your money is working hard for you.