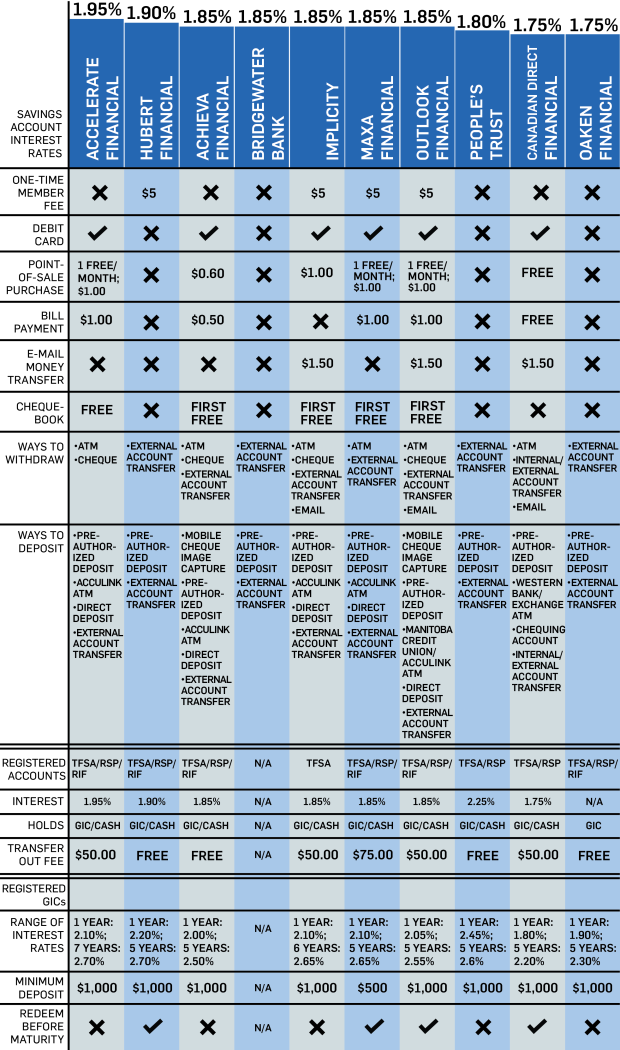

The last two decades have seen a mushrooming of branchless banks in Canada — but only 8 per cent of Canadians are taking advantage of them, according to a report on banking fees by the Financial Consumer Agency. That’s a shame, because branchless banks offer by far the highest-interest, with daily rates usually beating even 5-year GICs at the Big 5.

But they don’t advertise widely and can be hard to find, which is why we’ve done the heavy lifting for you and compared the services and fees at the top 10 Canadian banks that offer the highest-yielding savings accounts and registered GICs.

No worries if you’re not ready to ditch your Big 5 quite yet, because it’s smart to spread out accounts amongst various banks to take advantage of the different features and services each offer. The same applies to TFSAs, by the way, as long as you remain within your total annual contribution limits.

“I think it’s a very savvy move and reflective of those who are educated in their options,” says Penelope Graham, editor of RateSupermarket.ca, a website that tracks interest rates. “They know how to utilize the banking system to really appeal for their own financial needs.”

Thanks to websites and apps, multiple accounts are just as easy to manage as having different accounts at the same bank. Still, you shouldn’t be touching these too often. View even the savings accounts as no-risk investments you can easily get out of should an emergency arise — not as a replacement for your daily banking.

To really build your savings, consider setting-up a Pre-Authorized Deposit (PAD), similar to an Automatic Savings Plan (ASP), and schedule regular transfers, like on pay day.

Once the balance reaches around $1,000, an option could be to transfer it into a TFSA savings account or GIC to allow your small fortune to compound tax-free.

Some banks give you an ATM card and allow more comprehensive services, but make sure to look carefully at the fees — I’ve outlined the most common ones.

Hint: the only bank that is truly no-fee is Hubert Financial.

The hardest part of opening an account will be waiting in line at the post office for a stamp. Then just mail in a void cheque so it’s linked to your chequing account and you’re free to transfer money to and fro.

Check out the chart below to see a comprehensive comparison of each bank’s interest rates, services they provide and accompanying fees.

Most are subsidiaries of larger Manitoba Credit Unions, but every bank listed is open to all Canadians, with the occasional exception of Quebec, to join. After all, these banks are branchless, so as long as you have access to a telephone or computer and know where to score free Wi-Fi, you’re good to go.

Check out the chart below for a breakdown of what each institution has to offer. These rates are accurate as of May 1, 2015.