TORONTO -- Ontario will push for improvements to the Canada Pension Plan when provincial finance ministers meet in Toronto on Friday, and warns it is prepared to set up its own plan if necessary.

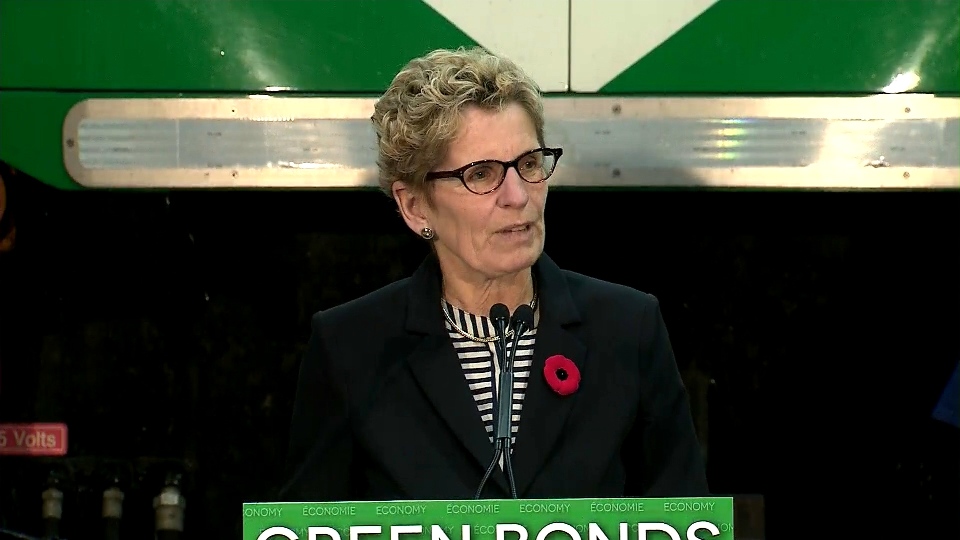

"I want to work with the federal government and other provinces and territories to enhance CPP, but I will find made-in-Ontario solution if I have to," Premier Kathleen Wynne tweeted Thursday.

Wynne recently met with some of her counterparts in other provinces to lay the groundwork on the proposed CPP changes in advance of the finance ministers meeting, although Alberta was cool to the idea.

"The CPP enhancement is our first choice, but if at the end of the day that doesn't work, I believe that it's our responsibility as a government to look at what the implications would be of having our own Ontario Pension Plan," she said.

"That's the position I advanced with (Manitoba) Premier (Greg) Selinger and (Alberta) Premier (Alison) Redford last week."

There is a wide range of issues for the finance ministers to discuss, from federal transfers to the newly created co-operative securities regulator, an alternative to the stalled plans for one national regulator like most other countries have, which is supported so far only by Ontario, British Columbia and the federal government.

"We'll be talking about Old Age Security, the fiscal impacts of our federal agreements and the co-operative securities regulator," said Ontario Finance Minister Charles Sousa.

But it's retirement income that is expected to dominate the talks, with Prince Edward Island pushing a proposal to hike maximum CPP contributions to $4,681.20 a year from $2,356.20 starting in 2016, and boost the maximum annual benefit to $23,400 from $12,150.

Some provinces favour so-called pooled pensions, but Ontario doesn't like that proposal, especially because they aren't portable like the CPP.

"They are not as reliable, and the CPP enhancement is our first choice," said Wynne.

Ontario wants to make sure whatever changes to the CPP are considered they take into account the potential impact on employers. Workers and companies currently split the premiums, which are 9.9 per cent of a workers' annual salary.

"I believe that there's a consensus across the country that this needs to be addressed, and so it's very important to me that we advance that and my hope is that we will be able to get some consensus," said Wynne.

Workers in Ontario realize there is a serious problem with retirement income levels, but it's the federal government and Finance Minister Jim Flaherty that will have to change position before any improvements will happen, said Wynne.

"The convincing has to be across the country and with Mr. Flaherty," added Wynne, who admitted Ontario workers could end up with two government-run pension plans.

"Imagine the scenario where there was some enhancement to the CPP but it was determined by us or by other provinces that it wasn't adequate, there isn't anything to suggest that you couldn't do both," she said.

"My hope is that we can get a full enhancement of the CPP but we have not determined what that would look like, what the models would be. That's what the finance ministers are talking about."

The Canadian Labour Congress has been calling for a doubling of CPP benefits for all Canadians, noting the finance ministers have been talking about the issue for several years without making any real headway.

"If we phase in a small premium increase over seven years, it would result in a future doubling of maximum benefits," CLC president Ken Georgetti said in a statement.

"Expanding the CPP is the only way to secure the future for today's young workers."

The country's premiers, who call themselves the Council of the Federation, will hold a followup meeting in Toronto Nov. 15 to continue the discussions on CPP reforms.