The Conservative government plans to chop its emergency fund by two-thirds this fiscal year in a long-promised effort to balance the books, according to the federal budget tabled Tuesday.

Given the economic risks resulting from plummeting oil prices, the government plans to reduce its contingency fund -- set aside for unforeseen events -- to $1 billion this fiscal year from its normal $3 billion annually.

The plan for a $2-billion reduction of the fund comes as the government projects a $1.4 billion surplus – and its first balanced budget in eight years.

The annual contingency fund is normally set aside for emergencies such as natural disasters or economic uncertainty. In fact, the C.D. Howe Institute recently said the reserve should be doubled to $6 billion, even if it means fewer economic promises and smaller surpluses.

Speaking to reporters Tuesday, Finance Minister Joe Oliver defended the government’s decision to cut the contingency fund. He went on to criticize the Liberals for hoarding money in the reserve in the past.

“Compared to the Liberals … I think their number was well over $30 billion. They created a slush fund,” said Oliver. “That’s not what we will do.”

According to budget documents, the contingency fund will gradually increase to $3 billion by 2019.

Liberal Leader Justin Trudeau fired back Tuesday, suggesting the budget is "very much a plan" for the Conservatives to win re-election.

"The reality is this government has done everything it can to come up with a budget that will be balanced this year," he said, adding there's no real plan for jobs or growth.

NDP Leader Tom Mulcair called the fiscal blueprint a "typical Stephen Harper budget," blasting details related to widely-expected increases on TFSA limits.

"He's taking money from the middle class to give it to the richest people in our society. He’s going to create more inequality," Mulcair said. "Increasing the Tax-Free Savings Account is great if you’ve got $60,000 in your back pocket.”

Oliver tabled the government’s fiscal plan in the House of Commons on Tuesday.

The Department of National Defence received the most money -- $12 billion over the next decade.

Canadians from all walks of life, including seniors, students and the disabled, also stand to benefit from the budget.

Here are the highlights from the 518-page document:

Defence

The Conservative government has made the safety of Canadians a big priority, especially following two jihadi-inspired attacks on Canadian soil last October. But that commitment came with a hefty price tag in Tuesday’s budget.

The government will provide the Canadian Armed Forces with more than $360 million to fight the Islamic State in 2015-16 alone. The money will continue to support the 69 Canadian troops training Kurdish Peshmerga forces on the ground in Iraq, as well as the Canadian fighter jets dropping bombs as part of the U.S.-led airstrikes over Iraq and Syria. Canada’s mission has a mandate to run until the end of March 2016.

The government will also boost its funding to the Armed Forces by providing $11.8 billion over 10 years starting in 2017. And it will provide $23 million over four years to upgrade the physical security of Canada's bases, starting this year.

Plus, starting this year, the government will set aside $7.1 million for the Canadian Forces to train troops in Ukraine. Last week, the Canadian government announced its plan to deploy 200 troops to the eastern European country for two years to help train local soldiers fighting separatists there.

National security

Following last year’s shooting attack at the National War Memorial that left a Canadian reservist dead, the government announced Tuesday that starting this year, it will provide $10 million over five years to the City of Ottawa to support policing in the nation’s capital. It will also dedicate $60.4 million over three years to beef up security on the Hill.

Also starting this year, the government will provide intelligence and law enforcement agencies, including the RCMP, the Canadian Security Intelligence Service (CSIS) and the Canada Border Services Agency (CBSA), with almost $300 million over five years to fight counter-terrorism.

The government will also double the budget of the Security Intelligence Review Committee (SIRC), the review body of CSIS. SIRC will be given $12.5 million over five years starting this year, and $2.5 million ongoing thereafter.

The announcement comes as the critics continue to call for parliamentary oversight of Canada’s security agencies -- a measure the government did not include in its new anti-terror legislation.

Seniors and people with disabilities

Starting this year, the government plans to reduce the minimum withdrawal amounts for the Registered Retirement Income Funds (RRIFs), allowing seniors to earn more on their investments and pay fewer taxes. Under the current law, seniors must draw minimum amounts from their RRIFs annually, starting at 7.38 per cent at the age of 71, and maxing out at 20 per cent at 94 years old. The proposed new RRIF minimum withdrawals would start at 5.28 per cent at the 71 and cap at 20 per cent at the age of 95.

The government also unveiled a new tax credit for seniors and people with disabilities to help with renovation costs to make their homes safer and more accessible. One of the goals of the "Home Accessibility Tax Credit" is to help people remain in their homes for as long as possible, according to budget documents.

Changes to Employment Insurance

The government plans to cut Employment Insurance (EI) premium rates from $1.88 in 2016 to $1.49 in 2017, a reduction of 21 per cent. According to the budget, any surplus from EI collections will be returned to employers and employees through lower EI premium rates.

And starting next year, Canadians caring for gravely ill or dying family members will be able to claim EI Compassionate Care benefits for six months, up from the current six weeks.

Students

The government introduced two measures in Tuesday’s budget to make student grants more accessible.

Starting in 2016, the government will provide $119 million to reduce the expected parental contribution to the Canada Student Loans Program. The budget did not indicate by how much the contribution rate would be reduced. It suggested the measure would provide increased support to 92,000 students.

The government also plans to expand eligibility for low- and middle-income Canadians hoping to access student grants for short-term educational programs. The measure is meant to help Canadians upgrade their skills for quick entry into the labour market.

Veterans

The budget outlined a number of support measures for veterans, many of which were introduced prior to Tuesday. New is a program for moderately to severely injured veterans. The Retirement Income Security Benefit will ensure the income of eligible recipients does not fall below 70 per cent of the income they were receiving through other National Defence and Veterans Affairs benefit programs.

Aboriginal support

Aboriginal youth are one of the fastest growing populations in Canada, but they continue to face barriers to employment. Starting this year, the government will provide almost $250 million over five years to support aboriginal labour market programming. The training will equip aboriginal people for jobs in high-demand sectors, including high-skilled jobs.

Health

The federal government will boost health-care transfers to the provinces and territories to $40.9 billion by 2019, up from $32.1 billion.

And the Canadian Centre for Aging and Brain Health Innovation -- based out of Baycrest Health Sciences in Toronto -- will receive up to $42 million over five years. The funding will support new research and development of products and services related to brain health and aging.

TFSA

As promised, the government will increase the annual contribution limit for Tax-Free Savings Accounts to $10,000, starting in 2015.

Canada's sesquicentennial

The government plans to drop a large amount of cash on Canada's 150th birthday in 2017 -- $210 million over four years, starting this year. According to the budget, the funding will be used to support initiatives such as local festivals and concerts, as well as enhanced Canada Day celebrations.

Memorial for Moncton RCMP officers

The government will set aside $1 million for a memorial for three RCMP officers shot and killed in Moncton in 2014. Constables David Ross, Fabrice Gevaudan and Douglas Larche were killed when Justin Bourque went on a shooting rampage across the city last June.

Infrastructure

For years now, municipalities and provinces have been pleading for more money for roads, bridges, highways, waterworks, transit and other infrastructure projects.

They’ll get some of that funding right away, but will have to wait for another aspect of it, according to the budget.

Starting in 2017, the Public Transit Fund will provide $750 million over two years, and $1 billion thereafter, for new public transit infrastructure in Canada’s large cities.

On Tuesday, the government also reaffirmed its infrastructure commitments outlined in the 2013 budget, known as the New Building Canada Plan. The government will continue to provide $5.35 billion per year to help support provincial, territorial and municipal infrastructure.

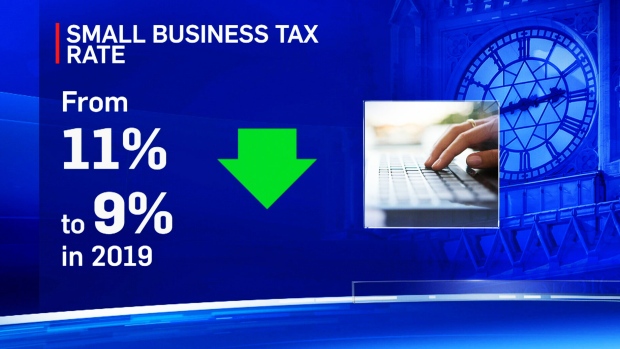

Small businesses

After years of slashing corporate tax rates, small business will finally feel similar relief. Starting now, the small business tax rate will begin a gradual reduction from the current 11 per cent to 9 per cent by 2019. Nearly 700,000 small businesses are expected to benefit from the proposed tax cut.

Manufacturing and automotive sector

Canada’s struggling automotive industry, which consists of many small- and medium-sized businesses, also got some attention in Tuesday’s budget. The government unveiled its plans to provide up to $100 million over five years to support product and technology development by Canadian automotive parts suppliers.

The manufacturing industry will also feel some tax relief. The government will extend the temporary capital cost allowance until 2025, allowing companies to write off the cost of machinery quicker and, therefore, lower taxes. The measure aims to encourage the manufacturing sector to invest in machinery and equipment.

Manufacturing spending is part of the Conservative government's attempt to satisfy Ontario and its large body of voters.

Many of the budget measures do not come into place right away, meaning the Conservatives will need to form government after the fall election in order to implement a number of their promises.