The federal government has been defending its proposed small business tax changes despite opposition from many of those who will be affected.

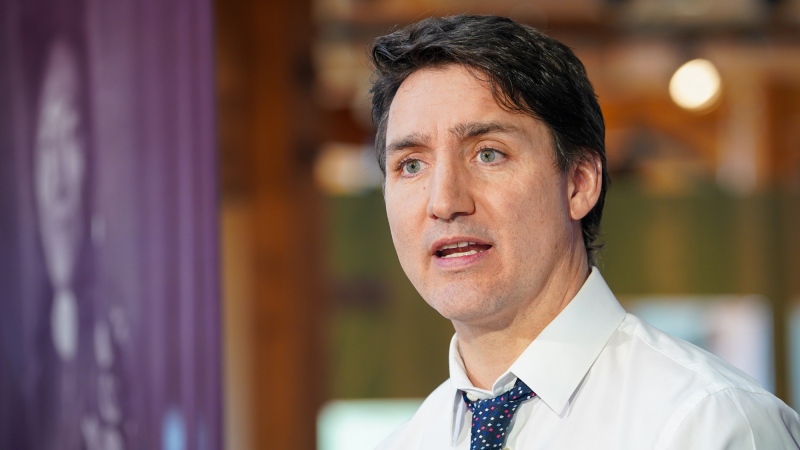

Finance Minister Bill Morneau and Prime Minster Justin Trudeau have stood firm on the controversial plan, saying the tax changes are about making the system fair, rather than generating revenue for the government.

Here’s what you need to know about the Liberals’ latest tax plan.

What are the proposed tax changes?

In July, Morneau announced the plan to close three loopholes which the government says have allowed high-earning business owners to avoid higher tax rates.

The changes will target so-called “income sprinkling,” which allows a business owner to split his or her income among family members, whether they are involved in the business or not. The government also wants to change methods of converting income into dividends and capital gains, and limit passive business income taxation.

The government says the biggest impact will be felt by business owners with annual incomes of $150,000 or more, or those who have money to tuck away after contributing the annual maximum to RRSPs and TFSAs.

The Liberals are soliciting feedback from Canadians on their tax proposal until Oct. 2, when the consultation window closes.

What is income sprinkling?

Income sprinkling allows business owners to divert their income to lower-earning family members by paying them salaries, wages or dividends, even if they don’t work for the company. That reduces the family’s overall tax burden.

The Department of Finance estimates 50,000 Canadian families are using income sprinkling strategies. It also says, by closing the loophole, the federal government could save $250 million a year.

The government now wants to apply a “reasonableness test” to income sprinkling to determine whether a business owner’s adult children actually contribute to the business.

The test would involve, in part, determining whether a family member is actively engaged in the activities of the business. The salary or wage they receive would not be considered “reasonable” if the amount exceeds what “an arm’s length party” would have agreed to pay to the individual for the type of work they do.

More details about the proposed changes are available here.

How are capital gains involved?

Capital gains refer to profits earned from the sale of securities, stocks or property above the purchase price.

The government says converting a private corporation's income into capital gains can provide “an unfair opportunity to reduce income taxes,” by taking advantage of the lower tax rates on capital gains.

Business owners can currently take out the retained earnings of a corporation and sell some shares to a holding company, where the earnings don’t get taxed.

Under the proposed changes, accessing those assets would result in immediate taxation, which some business owners say will make growing a company and planning for retirement difficult.

What is passive investment income?

Passive investment refers to income derived from a portfolio of investments, as opposed to active income earned from running a business.

The Department of Finance says that some individuals unfairly benefit from retaining passive investments in their corporations because they are taxed at the much-lower corporate rate.

“This is a problem when an individual holds money inside a corporation, not to invest it in growing the business, but simply to shield it from the higher personal tax rate,” the department says.

What do the critics say?

In addition to small business owners, the proposed changes have also upset some Canadian farmers, lawyers, tax planners and other professionals who use incorporation to reduce their tax burdens.

The planned changes to income sprinkling will especially affect farming families, who divide the labour and profits of the business, said accountant Allan Sawiak, who specializes in agricultural tax and family farmland planning.

He said some people are worried that their contributions to the family farm may be discounted under the “reasonableness” test.

“These rules, they don’t work with farms, they don’t work with reality of farms at all…It’s very unfair,” Sawiak told CTV’s Power Play Wednesday.

Sawiak said that various farm lobbying groups have been putting in submissions to the government on the proposed tax changes, but most individual farmers have been too busy with summer harvests to speak out publicly on the issue.

“They’ve got crops to bring in,” he said.

The Canadian Taxpayers Federation is also against the plan and recently hired a small plane to fly over Ottawa with a banner that read, "No Small Biz Tax Hike."

Since the fall session of Parliament began, the Conservatives have been attacking Morneau and Trudeau on the tax changes.

Conservative Leader Andrew Scheer has slammed the Liberals’ plan as “unfair” and accused the government of simply trying to pad its coffers instead of helping taxpayers.

Why are some doctors upset about the proposed changes?

Data from the Canadian Medical Association shows that a majority of physicians are incorporated, which means they can use the current measures to reduce their tax burdens.

The CMA itself is against the government’s tax proposal and some individual doctors have spoken out against it.

However, more than 400 doctors and medical students have signed an open letter to Morneau, saying that the government should follow through on the tax changes, but not without a transition plan.

With files from Rachel Aiello, Laura Payton and The Canadian Press