For the first time in 39 years, Canada is updating its preferential tariff regime, increasing tariffs on more than 1,000 items imported from 72 different countries.

The changes to the system will take effect in 2015 and are estimated to bring in $1 billion in additional government revenue over the first four years, according to last week’s federal budget.

Some estimates predict that the move will add an average of three per cent to the cost of popular items including electronics, clothing, shoes and appliances, prompting concerns that the added cost will be passed on to consumers.

The changes to the system affect a list of countries that have been receiving a break on tariffs and duties from the Canadian government for nearly 40 years.

Since 1974 Canada has been giving select developing countries a break on tariffs in an effort to help them grow their economies. Among the countries on the list are South Korea, China, India, Russia and Brazil.

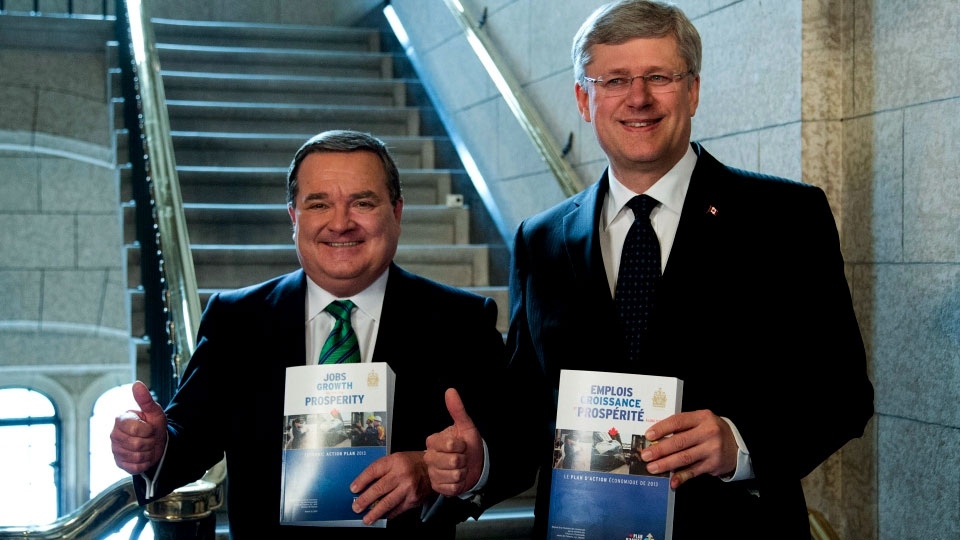

Finance Minister Jim Flaherty told CTV’s Question Period that the changes to the tariff system reflect the changing world economy, where certain developing countries are rapidly growing their economies.

“The list has not been reviewed since 1974. So we reviewed it in preparation for the budget and we removed countries that are no longer in that category, that don’t need that kind of assistance from Canada,” he said.

Flaherty said he had not calculated the effects of the increased tariffs on retail goods, but defended the government’s decision.

“I haven’t costed retail goods. We know that they’ll be some consequence to the change in who gets the preferential tariff compared to others,” he said.

“We should not be subsidizing by a preferential tariffs, countries that are no longer in that category of being underdeveloped countries. This includes the BRIC (Brazil, Russia, India, China) countries and they’ve been removed from the list,” he said.

When the government released its budget last Thursday, it highlighted the removal of tariffs on baby clothes and sports equipment, but relatively little mention of changing the preferential tariff regime.

Flaherty said that’s because the decision was ultimately a foreign aid arrangement.

“That’s why the general preferential tariff was created and we’re talking about countries now that are no longer entitled to that kind of assistance from Canadian taxpayers,” he said.

“We’re trying to modernize our tariff arrangement. It’s a preferential tariff. It’s designed for countries that are growing their economies that are relatively weak. That’s not true of China or Brazil or India or Russia, and that’s why we’ve taken them off the list.”

President of the Consumers Council of Canada Aubrey LeBlanc said while the new tariffs on face value are “certainly negative,” there are ways to mitigate the expected three per cent increase in costs.

“I think there’s an opportunity for the importers to, especially for goods from China -- one of the prominent 72 countries, negotiate pricing,” he said.

Jean-Michel Laurin, of the Canadian Manufacturers & Exporters, said that the introduction of new tariffs will have a “negligible” impact on consumers.

“We’re talking about preferential tariffs that only impact three per cent of the goods imported into Canada,” he said.

He agreed with Flaherty that it was time for the list of countries receiving preferential tariffs to be updated.

“It was meant to help developing countries. Countries like Hong Kong and Singapore, we were giving them preferential tariffs while their per capita GDP was higher than Canada’s,” he said adding that the U.S. updates its list every two years.

Laurin said the solution is for Canada to try to negotiate free trade agreements with individual countries.