TORONTO -- The Royal Canadian Mint is ending its experiment with digital payments, selling off its MintChip platform to Toronto-based financial startup nanoPay.

The government agency developed MintChip as a secure way to send and spend money online, launching the project in April 2012 and showing off its first implementation in 2014.

Consumers could use MintChip with a mobile device at a cash register or send money with a text message, email or potentially a social media message.

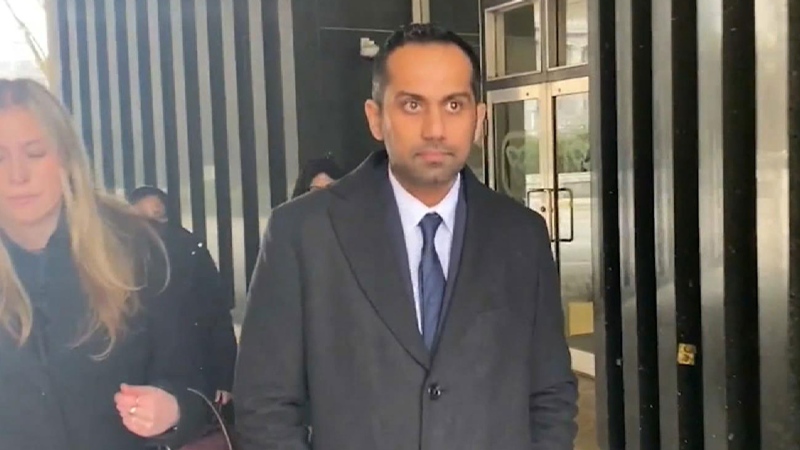

NanoPay CEO Laurence Cooke says the goal is for MintChip to replace cash as a go-to source for what he calls frictionless transactions, without the hassle and fees of payments linked to credit cards or bank accounts.

The system works much like a pre-loaded credit card, with consumers able to deposit value on their MintChip wallet from their bank account or credit card.

MintChip payments, like crypto-currencies such as Bitcoin, have lower fees and less processing time because they do not go through a central authority.

Yet unlike Bitcoin, which isn't backed by any central bank or government and fluctuates in value, the value of MintChip is tied to the Canadian dollar in the same way as a $20 bill.

Cooke said that Bitcoin also comes from more anti-establishment roots, while MintChip is fully compliant with Canadian regulations, including anti-money laundering and know your customer rules.

He said the MintChip platform is now live and processing transactions and will launch commercially in the coming weeks.

The company said it is working to integrate MintChip with banks and retailers, and will announce more partners in the coming weeks.

Companies including Apple and PayPal have launched their own digital payment systems in the years since MintChip was first announced, but the available options are fragmented between different devices, retailers and banks.

Jacques St-Amant, a professor at the University of Quebec at Montreal, said there is a lot of confusion in the marketplace about available mobile payment options, and that has hurt adoption rates.

St-Amant said mobile payment are also made more complex by rules that differ depending on the kind of product the mobile payment is linked to, with different approaches for payment systems tied to credit cards as opposed to those tied to bank accounts.

"It's almost impossible for merchants, for consumers, even for bankers to know what their rights and liabilities might be," he said.