TORONTO -- Lingering concerns about the Chinese economy dragged down the price of oil and again weighed on the Toronto stock market, which finished in the red for a ninth consecutive trading day.

The S&P/TSX composite index, which has lost more than seven per cent of its value since Christmas Eve, slipped 126.20 points on Monday, closing at 12,319.25. Metals and mining stocks were the biggest losers on the TSX, losing 7.5 per cent, while the energy sector closed nearly four per cent lower.

Meanwhile the commodity-sensitive loonie, which has been on a steep slide since the start of the year, fell 0.37 of a U.S. cent to 70.31 cents US. The last time the loonie closed below that was on April 30, 2003, when it finished at 69.76 cents US.

Craig Fehr, Canadian market strategist at Edward Jones in St. Louis, said the slump in China and its knock-on effects on commodity prices, especially oil, were responsible for the weakness in the Canadian dollar and the TSX.

"We're seeing a continuation of the weakness that started the year," said Fehr.

"The key drivers are pretty much the same. We're seeing further concerns about growth in China. ... That's leading to further declines in oil prices, and that obviously is having an impact on the domestic market as well as global markets as a whole."

The February contract for benchmark crude oil fell $1.75 to US$31.41 a barrel, while February natural gas lost 7.6 cents to US$2.396 per mmBtu. February gold fell $1.70 to US$1,096.20 an ounce, while March copper lost five cents to US$1.97 a pound.

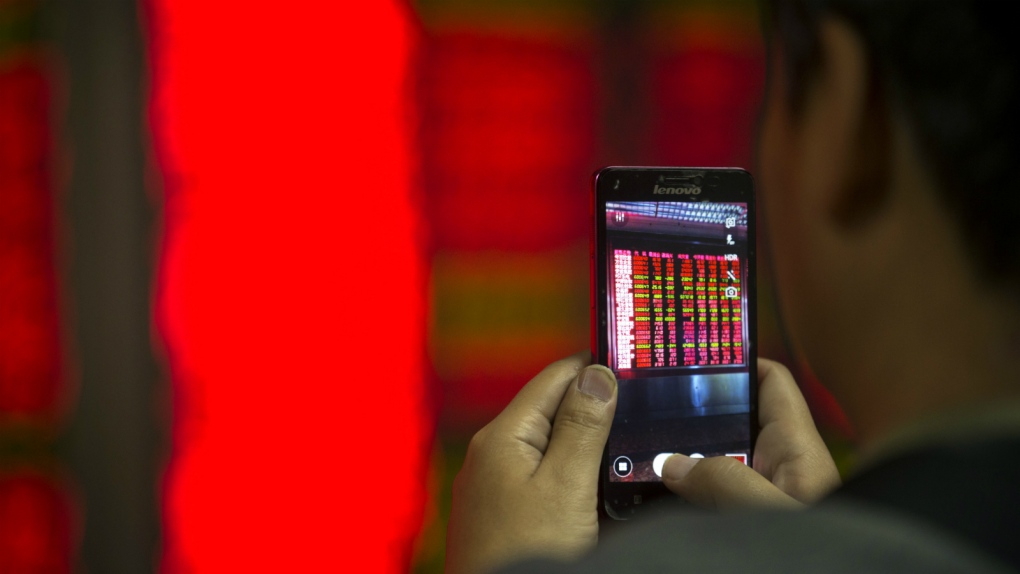

Chinese markets endured big drops last week, roiling markets worldwide, before rebounding Friday. But the Shanghai composite, China's main index, plunged again Monday, falling 6.3 per cent.

Fehr said investors were acting on concerns Monday that Chinese policy-makers may not have much influence in terms of stoking economic growth.

"There's not a whole lot of new news that's driving additional fear, it's just continued weakness as investors have taken on a little bit more of a pessimistic stance to start off the year," said Fehr.

In New York, markets were mixed after coming off their worst start to a year ever. The Dow Jones climbed 52.12 points to 16,398.57, while the broader S&P 500 gained 1.64 points to 1,923.67. But the Nasdaq slipped 5.64 points to 4,637.99.

The Bank of Canada released a new survey Monday which concluded that the hiring and investment intentions of companies have dropped to their lowest levels since 2009. The central bank said the fallout from plunging commodity prices is extending beyond resource-producing regions.

Fehr says oil prices should stabilize over the course of the year, but the coming weeks and even months could see continued volatility.

"Until we get some evidence that China is showing signs of a rebound, or until we get any new news about supply, I think there is going to continue to be overall pressure on oil prices," said Fehr.

"That being said, don't expect the (downward) trend that started in the middle part of 2014 to persist indefinitely."