TORONTO -- Experts are divided on what impact a federal Conservative promise to revive a home renovation tax credit could have on the real estate industry, with some predicting it could add more fuel to red-hot housing markets while others say it likely wouldn't have any impact at all.

Ahmed Helmi, a Toronto-area real estate broker with Royal LePage Real Estate Services Ltd., says the tax rebate could encourage homeowners to renovate and stay put, leading to lower inventories on the market.

In hot housing markets like the Greater Toronto Area, that could continue to push soaring home prices higher, Helmi predicts.

"There will be the same number of buyers trying to compete for a smaller number of homes that are available on the market," he says.

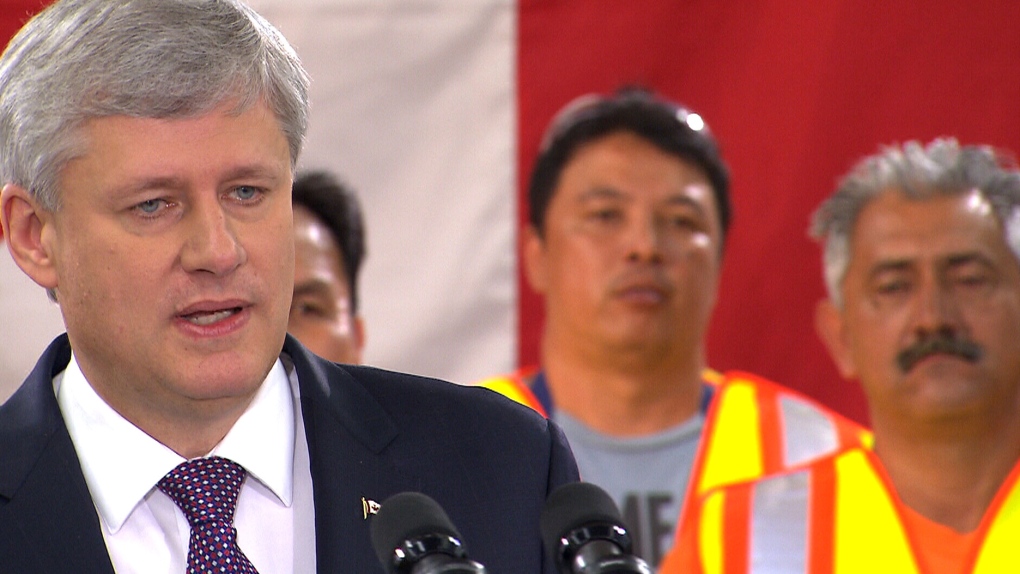

But Toronto broker Desmond Brown says Stephen Harper's election campaign promise to make the renovation tax credit permanent -- which the prime minister said is contingent on economic circumstances -- is "not going to make an impact at all" because the amount of money offered is too low.

The renovation tax credit was first introduced in 2009 as a temporary measure intended to spur the economy by incentivizing consumers to spend during the recession.

However, the new program -- which would offer homeowners a 15 per cent tax refund on renovations of up to $5,000 -- would pay less than the last, which provided a rebate on up to $10,000 of total spending.

"You can't do a heck of a lot for $5,000," said Brown. "That might be the floor in a kitchen."

Toronto realtor Derek Ladouceur said the tax credit might encourage a small number of Canadians to flip houses -- purchasing fixer-uppers, renovating them and then putting them back on the market -- but overall, the measure is unlikely to have any "profound effect" on the real estate market.

"To add a stimulus into the only aspect of the economy that is strong right now -- the housing market -- doesn't make a lot of sense to me," Ladouceur said.

David Madani, an economist with Capital Economics, said the government is "playing with fire" by encouraging homeowners to take on more housing-related debt, noting that most Canadians fund renovations by borrowing against their homes.

"The government is truly addicted to housing specifically as a source of economic sustenance, despite countless warnings from the Bank of Canada and international institutions such as the IMF and OECD among others," Madani said in an email.

But Will Dunning, the chief economist at the Canadian Association of Accredited Mortgage Professionals, said programs such as the renovation tax credit don't change consumer behaviour -- they merely subsidize and speed up activity that was going to happen anyway.

"Yes, there may be a short-term surge in activity as a result of the introduction of the program, but that's going to be offset later on, when the activity that was going to happen, say, a year from now, has already happened," he said. "The real impact of this is going to be negligible."

The Canadian Home Builders' Association welcomed the announcement, saying the tax credit would help bring money out of the underground economy -- a "chronic problem" in the renovations and repairs industry, where many contractors are paid under the table.

"Tax credits that require homeowners to get receipts also help to protect them from 'cash' contractors who leave a trail of bad work and broken promises," Kevin Lee, the association's chief executive, said in a statement.