TORONTO -- The Toronto stock market ended higher on Monday as new data about the Canadian economy and comments from the U.S. Federal Reserve gave investors reason to cheer.

The S&P/TSX composite index gained 74.59 points to close at 14,335.31.

The Canadian dollar was at 90.46 cents US, rising 0.04 of a cent, after Statistics Canada reported the economy grew more than expected in January. Gross domestic product rose by 0.5 per cent, ahead of the forecast of 0.3 per cent growth.

Economists had expected the economy to rebound after declining 0.5 per cent in December, when bad weather affected much of the country.

Gareth Watson, vice-president of investment management and research at Richardson GMP Ltd., said he wouldn't use the GDP figures as a barometer for good things to come.

"Canada still probably faces more challenges and more headwinds compared to the United States and some other economies," he said.

"The data that's coming out on Canada is not making people overly bearish, but there is a bit of concern, and I think a great indicator of that is the loonie.

The loonie has tumbled four per cent so far this year.

In the United States, investors anxious that the Fed might raise short-term rates starting in mid-2015 were given a clearer road map for the coming months.

Federal Reserve chairwoman Janet Yellen said she thinks the struggling U.S. job market will continue to need the help of low interest rates "for some time." Yellen previously suggested that the Fed could start raising short-term rates six months after it halts its bond purchases, which most economists expect by year's end.

On Wall Street, the Dow Jones industrials added 134.60 points to 16,457.66, the Nasdaq lifted 43.23 points to 4,198.99 and the S&P 500 index rose 14.72 points to 1,872.34.

In commodities, the May crude oil contract fell nine cents to settle at $101.58, with the TSX energy sector 0.7 per cent higher.

Gold stocks were the biggest decliner as June bullion fell $10.50 to end the day at US$1,283.80 an ounce. May copper slipped 1.5 cents to US$3.03 a pound.

Nordion Inc. (TSX:NDN) was one of the most heavily traded company on the TSX following a friendly US$727-million takeover offer for the health sciences company on Friday. The stock was up 10.6 per cent or $1.22 at C$12.74 with 5.8 million shares exchanged.

In corporate developments, Encana Corp. (TSX:ECA) has agreed to sell certain natural gas properties in Wyoming for about US$1.8 billion to an affiliate of TPG Capital. Encana shares lost nine cents to $23.61.

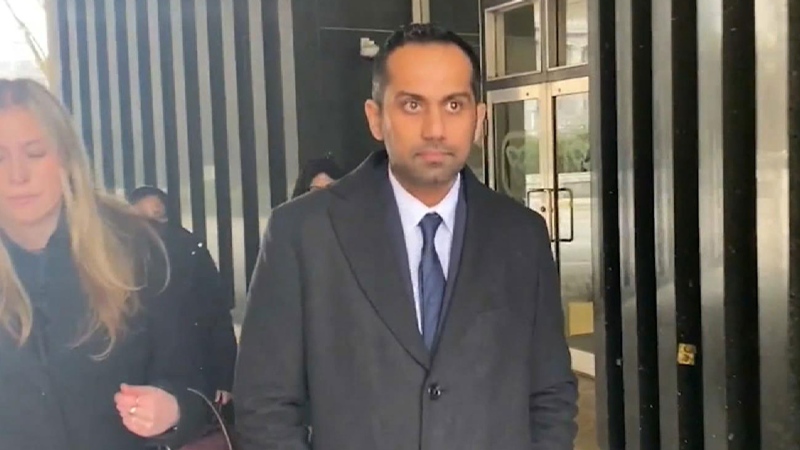

Telus shares (TSX:T) dropped 72 cents to $39.63 after the company announced Darren Entwistle would be stepping aside as president and CEO of one of Canada's largest telecommunications companies. He'll be replaced by Telus veteran executive Joe Natale effective May 8, when the company has its shareholders meeting.

In the technology sector, BlackBerry (TSX:BB) shares pulled back nearly four per cent following its fourth-quarter and year-end results on Friday which showed there's still much work ahead in CEO John Chen's effort to rescue the operations. Its stock closed down 36 cents to $8.95.

Canadian autoparts manufacturer Martinrea International Inc. (TSX:MRE) is looking for a new president and chief executive officer to replace Nick Orlando, who will remain in the position for now. The announcement came as Martinrea reported financial results for the year and fourth quarter ended Dec. 31 and said a special committee of its board has concluded its review of earlier public disclosures and determined there's no need to change earlier statements. Shares of Martinrea were up $1.20 or 13.7 per cent to $9.97.

In the United States, Johnson & Johnson shares rose one per cent after the company accepted an offer of about $4 billion from the private equity firm Carlyle Group to buy its Ortho-Clinical Diagnostics business.