TORONTO -- Tax planning may be the last thing on Canadians' minds as they get ready for the hustle and bustle of the holiday season.

But now is the time to take advantage of credits and benefits available to you until Dec. 31, says Jamie Golombek, managing director of tax and estate planning at CIBC Private Wealth Management.

Otherwise, you may be leaving money on the table that you won't be able to claim in the new year.

"Most of the planning has to be done in the tax year that you're in," Golombek notes.

Keep in mind that, while some new personal tax credits have been introduced this year, others are being eliminated, adds Karin Mizgala, a certified financial planner and co-founder of Money Coaches Canada.

Here are four tax-savings strategies to consider before the clock winds down on 2016.

Maximize medical expenses

While medical expenses must be paid by Dec. 31 to a claim a tax credit for 2016, the related good or service doesn't have always need to be acquired in the same year, according to Golombek.

He says this provides an opportunity to prepay certain items for 2017 and claim them for 2016 if it enables you to exceed the minimum threshold required to qualify for a tax benefit.

"An example I often give is if a child needs braces or orthodontist work," he says. "You might be able to get a medical expense credit right away for the amount paid this year, even if this is something that may be ongoing for the next number of months into the new year."

A tax credit can be claimed when total medical expenses exceed the lower of three per cent of your net income or $2,237 in 2016, Golombek detailed in a recent report.

Don't delay charitable donations

If you're thinking of making a charitable gift in the near future, be sure to do it before the end of the year so that you'll get a donation credit right away to reduce your 2016 taxes.

"If you wait until even Jan. 1 you're going to wait for a year if not longer before you'll see the benefit of the donation credit," Mizgala says.

Both the federal and provincial governments offer donation tax credits that, in combination, can result in tax savings of up to 50 per cent of the value of your gift in 2016, adds Golombek.

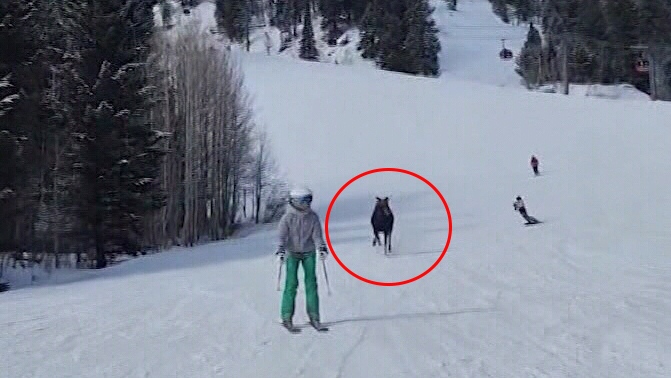

Pre-pay children's arts and fitness activities

Ottawa is phasing out both of the children's arts and fitness tax credits this year, meaning you only have until Dec. 31 to take save up to $250 of expenses on artistic or cultural activities and up to $500 of expenses on physical activity programs.

"So if someone is not spending enough money in 2016 to maximize those credits maybe they could prepay some of those expenses for 2017," says Golombek.

"Let's say your kids are taking swimming lessons in January: You could you register now for the January semester, get that credit and use that if you're not already maxed out."

Renovate for home accessibility

Introduced this year is the home accessibility tax credit to help seniors and people with disabilities with the cost of home renovations designed to make life simpler and safer.

The tax credit is equal to 15 per cent of expenses for those spending up to $10,000 per year on things like wheelchair ramps and walk-in bathtubs, says Mizgala.

For the 2016 tax-filing year, it applies to payments made before the end of year for work performed and/or goods acquired.